The Minvest Mission to Empower Gen Z Investors

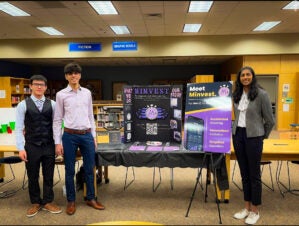

How is it possible? In the first 30 episodes of our Future of the Business World podcast, we have yet to dedicate an entire discussion to investing. As the creators of the Wharton Global High School Investment Competition (one of our favorite innovations), Wharton Global Youth knows better than anyone how passionate Gen Z is about investing. That’s why this month (No. 31), we’re excited to meet Arjun Setty and Raaga Kodali, two high school juniors from Virginia who are creating an app and online platform to simplify the investing-research process for their generation. They recently released their beta version, taking an iterative approach of time-releasing new features in order to gather valuable feedback from their market and make critical changes along the way. We discuss many aspects of their start-up story as they work toward making investing research quick, easy and accessible for young investors.

Be sure to click on the arrow above to listen to the podcast. An edited transcript of our conversation appears below.

Wharton Global Youth Program: Hello and welcome to Future of the Business World, the podcast featuring teen innovators from across the globe. I’m Diana Drake with the Wharton Global Youth Program at the Wharton School, University of Pennsylvania. Wharton Global Youth introduces high school students to business and finance education, through on campus and online summer programs, as well as competitions and content. Part of our regularly published content is this podcast, where we get to learn from some fascinating young innovators.

Today, we welcome Arjun Setty and Raaga Kodali, high school students from Virginia who have been building a new finance platform for aspiring Gen Z investors. Arjun and Raaga, it’s great to have you on Future of the Business World. Why don’t you both tell us a little bit about yourselves?

Arjun Setty: Of course. I’m Arjun Setty. I’m a high school junior at Potomac Falls High School and the Academies of Loudoun. The Academies of Loudoun is a Magnet school in Loudoun County, Virginia. So right near the [Washington] D.C. metropolitan area. And I am the CEO of Minvest.

Raaga Kodali: Hi everyone. My name is Raaga Kodali. I am also a junior. I attend the Academies of Loudoun and Briar Woods High School, again in that D.C. metropolitan area. And I’m currently the Chief Operating Officer of Minvest. It is an honor to be here today.

Wharton Global Youth: We’re very happy to have you both. As I was preparing for our discussion, I realized that in the 30 published episodes of Future of the Business World, we have yet to dedicate an entire conversation to investing. As you may know, Wharton Global Youth Program runs a successful investment competition each year that engages thousands of high school students around the world. So, we have an immediate audience for today’s conversation — and then some. And we have seen the faces and heard the voices; lots of students have investing on their minds. So, I’m excited to get started. Arjun, at least part of your interest in the financial markets began while you studied with us in the Wharton Pre-baccalaureate Program. Can you tell us a little bit more about that?

Arjun: Last fall, I enrolled in Finance 0001, with Professor [Gizem] Saka. And really this provided me with a deeper level of insight into finance and economics. Now, this course didn’t really focus too much on investing per se, it really focused a lot more on macroeconomic movements. And while I didn’t really realize it as I started this course, it helped me understand how these large macroeconomic movements that we see right now, like inflation, or maybe the housing market taking off, how they all derived from the collective choices that we make as individuals. And that made me understand the importance of understanding not only these large macroeconomic trends, but also microeconomics and the financial choices that we make as consumers at the smaller scale.

Wharton Global Youth: So, let’s connect the dots then. The name of your startup is Minvest, which you describe as a digital platform that simplifies, personalizes and accelerates the investing-research process for young investors. Tell us more.

Arjun: Minvest is an investing-research platform, made by Gen Z for Gen Z. And what we aim to do is make investing research quick, easy and accessible for young individuals. This derives from the problems that we faced. In the beginning of my sophomore year, for instance, I had just started investing, and I was totally lost. When I went out there, I realized that a lot of finance and investing platforms really haven’t been built with Gen Z in mind, even though there’s so many people out there that are very interested in actually investing. I discussed this with Raaga, and Bi [Nguyen], my other two cofounders. And we realized that we shared this same problem with each other. We went out there and we actually interviewed over 57 people. And this confirmed our findings. People want to invest, but they simply can’t, because of three main barriers that we found: the lack of time, a fear of risk, and limited education.

Minvest addresses all three of these problems individually. For instance, we took care of the lack of time by creating something called the One Minute Market, where users can learn about and decide on the stock in under one minute. We also focused on addressing the fear of risk by offering a fully personalized interface where users can make their investments based on their financial goals, needs and preferences. And finally, we tried to address this limited education and fill that gap by offering real-time investor education in the form of bite-sized content, so that it’s easy and fun to learn about investing.

What really drove us to pursue this idea was something that I learned in Professor Saka’s course. In a time with rampant income inequality, I think the number is around 64% of Americans living paycheck to paycheck, all three of us wanted to ensure that our generation is well equipped to take control of their financial future. That kind of mission and seeing these problems that our generation faced, really inspired us to go ahead and create Minvest to solve these problems.

Wharton Global Youth: Raaga, are you also an investor?

Raaga: I’ve been investing since sophomore year, when me, Arjun and Bi talked about our problems. I went out and started experimenting on my own. And I’m actually a part of the Briar Woods High School Wharton Investing Club. And so, we participated in the [Wharton Global High School Investment Competition] this past year. it was an incredible experience, and really helped me understand investing and the strategies and all the analysis that go into it from a deeper level.

Wharton Global Youth: Excellent. Well, it’s nice to hear that we’re also contributing to that piece of education that you both feel is missing for Gen Z to be prepared in the investing market. Raaja, let’s stay with you for a minute. There’s a company or a group called Modak. And it’s been fundamental to the development of your startup from simply an idea to an actual venture. Can you tell me what Modak is and how it has inspired you through mentoring and ultimately grant money?

Raaga. For context, Modak Makers is a company that supports teenage entrepreneurs. They help budding entrepreneurs develop their ideas and make them into realities. And they host a yearly pitch competition where a lot of these teenage entrepreneurs from across the world come together for the chance to compete to potentially win some grant money, and earn a mentorship from the Silicon Valley experts that run Modak. And so, with Minvest we actually [advanced through] two rounds of competition to ultimately win the Modak Makers pitch competition. Along with this, we had worked with the Silicon Valley mentors, especially the CEO of Modak. His name is Madhu Yalamarthi. He was an incredible mentor, friend and just provided super important guidance for us throughout the process. And with his help, we turned our idea into a reality. We were also awarded a $6,000 grant to kickstart our MVP [Minimum Viable Product], and to make all of our ideas come into something tangible.

“The very risky and short-term investing mindset is actually the exact reason why so many people don’t invest.” – Arjun Setty, Co-founder, Minvest

Wharton Global Youth: That CEO mentorship sounds great. Can you tell us a little bit more about it? What about it was particularly impactful?

Raaga: One particular story comes to mind when I think about the relationship we were able to develop with the CEO. For one of the first meetings that we were talking to him, we were sharing some of the problems that Arjun had mentioned earlier. We were sharing those problems we had found, and how we felt they impacted Gen Z. He directly told us that they were not specific enough and that we didn’t dig deep enough. He advised us to start using something called the “Five Why’s” approach, where you start off with a high-level problem and you ask why five different times until you’re really whittled down to the core issues causing those problems for whoever’s facing them. With that, we went out, we conducted a lot more interviews, and we were able to come back to him with a lot more research and with a much deeper analysis of all the problems we were trying to solve. A really crucial part of any startup is your problem development and we were able to really enhance and dig deeper into it with his guidance and with all the support he provided. [It has] definitely been a crucial relationship that has helped Minvest kickstart as a startup, and we are very grateful for him and his help.

Wharton Global Youth: As a startup you are a team of 15, but I noticed that actually includes more than 10 interns. Can you talk about how this internship model has helped to propel your startup and deepen the knowledge and skills needed to grow?

Raaga: After we developed our solution, and we were getting ready to kickstart our MVP, the team took a step back and [said]: Okay, we don’t have the best graphic design, we don’t have the best development skills in the world. We realized that these were some areas that we really needed help with in order to make all the ideas with Minvest come into reality — something we could actually test and share with others. One thing about the Academies of Loudoun, which is the school where we all attend, is that they have specialty career pathway programs for students. There are career pathways in computer science, career pathways in graphic design, all these areas that we needed some assistance with. And so, we leveraged the resources around us and started an internship program through the Academies of Loudoun, where we worked with other high school interns that we found within the school. And that team has today grown to over 10 interns for development, graphic design and marketing. With all their help, our ultimate goal was to create our beta version and launch it. And so, our beta version, as we’ll talk about later on today, was launched on February 18, [2023]. We couldn’t have gotten there without the support and help of our interns.

Wharton Global Youth: Yeah, I’m excited to talk about the beta version. First, though, I want to clarify that MVP is minimum viable product, correct? We like to throw a lot of acronyms out there sometimes in business. And I just wanted to mention what that was all about. So, you are currently beta testing the initial version of your platform and you want to improve your product-market fit. I want to know why is this step so critical, this beta testing step? And what have you learned so far about your market?

Arjun: I think with beta testing, the importance of it not only stems from how important it is for startups to iterate when developing their products, but also from one of our core beliefs. From the onset, we really wanted to have a customer-oriented approach to developing our product, Minvest. And what this beta testing and this rapid iteration allows us to do is to put a version out there, see what the market likes, see what they dislike, and see what they want to add. And then for our development team to go ahead and add those features to the platform. We use something called the Agile process. Every version that we put out is super lean, super minimal. And what we focus on doing is rapidly changing and adapting to the wants and needs of our market.

Right now, with this first beta version, we haven’t necessarily released every feature that we want to have out there, we’ve put forward almost like a blank canvas with the most basic features. We’re trying to experiment with this. It’s almost like the scientific method, if you will, to see what sticks, what doesn’t, and what we can add. This rapid iteration is what we’re trying to focus on right now. And one thing that this beta testing process has allowed us to see is how high the demand for investor education really is. Everyone we’ve talked to, and the people that we’ve sent out our beta version to, have really liked the approach that we’re taking to this investor education. How we’re promoting it in more bite-sized content that is quick and easy to understand. And I think that really stems from the fact that people talk about investing like it’s a very obscure topic. People are really curious about it and want to see it conveyed and explained in a no-frills sort of way.

Wharton Global Youth: I want to drill down for a minute on one aspect of what you’re offering on your platform. You say that you can learn about and decide on a stock in less than one minute. And when I think about that, it really flies in the face of our [Wharton Global High School] investment competition mission, which is to steer students away from risky short-term investing decisions, and help them see the value of analysis and long-term investing. I’m wondering, what are your thoughts on the rise of apps like Robin Hood and the get -rich-quick mindset, especially in Gen Z? How do you address this through Minvest?

Arjun: I think it’s really interesting that you mentioned this, since the very risky and short-term investing mindset is actually the exact reason why so many people don’t invest. In fact, it makes me think of one of the interviews [I had with a student] earlier. I said, what’s the first thing that comes to your mind when you hear the word investing. They said, numbers flying all over the screen, and people making trades super quickly and lines flying everywhere. Obviously, there are a lot of things wrong with that answer. But one thing that it really highlights is how the short-term investing mindset has almost been a poison that’s preventing so many people from investing. So, what we do is address this problem through the One Minute Market and personalization. The One Minute Market actually does foster long-term investing. It simply just allows the users to learn about and decide on a stock in under one minute. And this stock can be held for as long as possible. In fact, it is enhanced by the personalization that we offer. It takes the user’s preferences into account and provides them with investing options that match their financial goals and their preferences. For instance, if you’re someone who’s very low risk, then [it would] recommend stocks with something called a lower beta to you, which are just lower risk stocks. So we do foster this long-term-investing outlook. We just make sure that doing long-term investing and making investing decisions is as easy as possible for our users.

Wharton Global Youth: I’m curious. You’ve been getting to know your market a little bit better. And what have you learned about Gen Z-inspired trends in investing? We hear so much about ESG and socially responsible investing. I’m wondering how will today’s youth influence the market?

Arjun: So again, Minvest is by Gen Z for Gen Z. So, a lot of the features that we have are taking advantage of some of these Gen Z-driven investing trends. And I think ESG is a big one. In fact, in our interviews, one person mentioned how the lack of corporate social responsibility was one of the reasons why they don’t invest. [They] don’t want to support a company that’s destroying the environment. We got a similar notion from other people that we interviewed. In our demo, we introduced a feature that gave the ESG score and indicated whether the company had a high ESG rating, or a low one.

Wharton Global Youth: Arjun, I’m going to stop you and just say, we have one of these lovely acronyms that is finding its way into our conversation, I just want to explain that ESG [stands for] environmental, social and governance factors. And it really is looking at [making investment decisions] through that lens. And how socially responsible companies are. So, you continue with your answer.

Arjun: I think it’s great that you define ESG, because it encapsulates not only the environment aspect, but also the social and the governance aspect. I know a lot of people are looking at diversity, equity and inclusion in companies. And ESG really encapsulates that. Another huge [trend] that we’re looking to capitalize on is AI and natural-language processing, especially with the more qualitative analysis of stocks. To be fair, finance is not just about the numbers, there’s so many other personal dynamics that play into finance. So, really looking at the qualitative analysis and 10-K statements, for example, or the company’s press releases. In the future, we’re actually dedicating a lot more resources to see how we can incorporate some of this emerging technology into our product; to see how we can make investing more personal and really incorporate these other aspects.

Wharton Global Youth: Raaga will know from having competed in the Wharton Global High School investment Competition, that we really do stress that balance of qualitative and quantitative research. So, that’s very good to hear. What is the future of Minvest? Are you all dedicated to this? Or is it merely a passion project? Where do you see it going in the future?

Raaga: One thing I will say is that when we first created Minvest, never in our wildest dreams would we have guessed that it would have taken off the way that it has and that we would genuinely be able to turn this product from an idea to reality and learn all the crucial lessons we have. Although it did start off as a passion project, at this point, we have acquired just so much validation from those in our market that they want to see a product like this come to the market. They want a tool that can help them get into investing to take control of their financial future. And so today, with our beta testing, we are working to keep receiving more and more validation, to ultimately find an investor someday that is willing to fund the development of Minvest. The overall goal with this is to find that investor, make it professionally developed, and hopefully release on the App Store and make this available to the public. One really important thing we’ve realized is that our mission truly has the potential to impact the lives of millions of young individuals across the country. And so, we’re determined to keep building Minvest and to keep tailoring it to the needs of this generation.

Wharton Global Youth: Wonderful. So let’s wrap up with our lightning round. Why don’t you both answer these questions? The first one is: [What is] the next thing you hope to learn that you don’t yet know?

Arjun: The intersection between entrepreneurship and finance, especially with regards to venture capital. Seeing how finance can be used as a tool to in a sense help entrepreneurs and help the development of new ideas, and allow us to solve problems using business.

Raaga: For me, something I’m really passionate about learning now is how the world of business and law intersect. Legal studies is the career path that I plan on pursuing that I’m really passionate about. And so, with this sort of background, and entrepreneurship and finance, it would be interesting to see how all three of those worlds collide in the professional world.

Wharton Global Youth: All right, next lightning round question. Raaga, why don’t you go first. Something about you that would surprise us?

Raaga: Well, I am really tall. I’m six feet tall. And I’m an athlete. I play soccer and basketball. So, I think a lot of people wouldn’t necessarily expect that. But that’s always a fun surprise when I meet new people.

Arjun: kind of sticking with the whole tall athlete theme: I’m a member of my high school’s varsity ice hockey team. So again, a lot of people get surprised when I say that.

Wharton Global Youth: I’m not surprised. It sounds great. All right. Last question. You’re starting a business-themed talk show? Who is your first guest and why?

Arjun: I’m to keep the focus here on finance, because I know that’s what I’m really interested in. [My choice would be] Burton Malkiel. I really love reading his book (A Random Walk Down Wall Street). And it was really one of the first thing that taught me about the actual nitty gritty of investing and what it means to be a good and practical investor in the long run. So such a big inspiration for me, and he would definitely be the first person I put on the podcast.

Raaga: And for me, someone that I have just looked up to these past few years is Adam Grant. I know he does work with the Wharton School, and I would have him on the podcast because I read his book Think Again and it completely changed my perspective on the approach to life, work and how all of that intersects. I think it would be amazing to potentially meet him someday. I mean, if that somehow happened, that’d be incredible. That would be my first guest on a potential talk show.

Wharton Global Youth: Thank you both for joining us on Future of the Business World.

Conversation Starters

Arjun Setty and Raaga Kodali learn from Madhu Yalamarthi about the “Five Why’s” approach. What is this and why is it essential to product and startup development?

List three examples from this article that illustrate how these young entrepreneurs have problem solved to create a better Minvest platform. How have they been strategic in their approach?

Are you a Gen Z investor? What are your thoughts about Minvest? Would you use it? What are your personal barriers to investing that you would hope to address? Share your ideas in the comment section of this article.

I think that Minvest is a great app as I know many people, not just in the US but in the world, do not have access to information that allows them to understand the idea of investing. Not only that but many people do not know when investing is beside what is shown in tv series or shows. To some it is a foreign concept or it is a thing that is only for the “old” people. However, investing should be for everyone as it is a great way for people to make money and learn about the current state of our economy. As a person who took an investing class and is planning to major in business, I think this app is a great way for Gen Z to learn and hopefully get into investing. I can understand how without learning about investing it can be very confusing but once you know what is going on it is actually really easy and simple. Personally, I would use it to learn more about investing and to actually invest in stocks. My personal barriers that I would hope to address about investing is the idea of not taking a risk. I know many people would agree with me and know that currently the economy isn’t doing to well and that their are cons to investing in some stocks right now, however, there are also some pros because some companies could actually perform better in the near future, so many investors would get a high return on investment if they invest in the stock while its low. Honestly though, what you want to invest is all a personal preference, however if you ever get stuck and don’t know how to make a decision whether to invest or not, just do some research about the state of the company and its current event. All in all, I think Minvest is a great way to introduce investing to Gen Z and would totally use it myself.

I agree with you and I feel that risk is a big factor with stocks and when dealing with risk I feel like the app should show you how to take calculated risks because the stock market is mostly risk of you want to make a bigger profit.

As a high schooler who’s almost the same age as Arjun and Raaga, I struggle to fully express my excitement for this idea with simple words. Finance had also been my first choice for my future career pathing, and thus, the idea of getting into investments and buying stocks constantly hits. And just as the two young leaders expressed the bewilderment of stepping into this area that was never touched upon in school education, Minvest is the best cure to this issue. The concept of investing almost always seemed like a skill that is automatically acquired once reaching adulthood, but that is simply not the case. Yet, having to spend all the time on online investment simulators like “Wall Street Survivor” or “Investopedia” is also boring for the ambition of an adolescent. Half of the time when I use these simulators, I just read some blogs from SeekingAlpha and go off spending all 100k on those companies thinking that I have just ascended into the next Wolf of Wall Street, but truly, I have zero clue what I’m doing, all the concepts and professional terms the blogs use reminds me again and again of my ignorance. This is a barrier that I believe most Gen-Z investors have come across too, trying to find some articles to start with, but then questioning if you are reading English or not. Having something similar to a “key vocabulary page” would be helpful to the development of this app, this could include terms like “Liquidity” or “Volatility” and more, because, from my own true experience, it feels dramatically different after knowing what those words meant, almost as if you’re being enlightened. This so, Minvest can serve more of the teaching aspect of the platform, slowly leading these young spirits into a completely different world.

Ambition lies within every adolescent at our age to some extent, and Minvest offers a great opportunity to utilize the desire for one to be financially independent. Around this time and age, these desires are hard to restrict, but they are also beneficial if guided properly, I insist that what Arjun and Raaga had stepped into today is not simply a unique software development, but instead, a movement of youth independence and leadership.

I was thrilled to have found this podcast on the Global Youth page as it aligns directly with my ambitions and interests. Just like Raaga and Arjun, I started investing in my sophomore year. Similar to their experiences, I quickly noticed that our generation lacked in financial literacy and not many resources available on the internet were made for us. I was also scared of the risks that came with investing, but I mentally prepared myself for the best and worst that could come. One of the first lessons I learned was that of diversification. To this day, this is an aspect of investing that I preach to my peers. I not only diversify my sectors but also my type of investments. I hold investments in my portfolio that are for the long term, short term, and some that started as short term but have now transitioned to long term :). As my experience with investing has increased, I have learned more and more and I continue to learn to this day.

For this reason, I am very intrigued at the prospect of what Minvest could become. I feel that it could easily be a very helpful learning source for beginners. Minvest could easily teach rudimentary investing lessons such as the importance of diversification and how to read and analyze a company’s “books”. I am also fascinated and skeptical of what they call the “One Minute Market “. I myself spend hours on research to find the stocks that I want to invest in. If this program can really do what they say and give me a substantial amount of relevant information about a company in a matter of seconds, it would save me a lot of time. However, I feel that in some cases, the info/data that such a technology would give me might not be the type of info I am looking for. The indicators and data that make a stock a buy are subjective in my opinion. Some news or data about a company might make someone decide the stock is a buy while not affecting the sentiment regarding the stock for someone else. Therefore, when this app is launched, I will definitely try it and see if it can help me in my investing journey. In my opinion, however, such an app should not lead all your decisions. It should be used as a resource in order to reach your opinion of whether or not you want to invest in a company. I do, however, believe that it can be a vital resource for beginners in their journey and help them learn as they dedicate more time to the craft

Great points, Mohamed! Thanks for contributing to this great thread of investment interest and ideas for the Minvest team.

As a Gen Z individual with three years of Business classes and also has a keen interest in the financial market, I still consider myself too young to actively participate in the stock market and hesitant about start investing money in firms. Watching my parents engaging in investments with different firms, big and small, makes me believe that this job is exclusively for professionals and experts! With all my knowledge, I learned that investing is a risky job that requires a high level of responsibility, even for adults from previous generations who also sometimes experience great failures in this field.

However, while reading this transcript, I found the start-up story of a new app from juniors from Virginia very inspiring, particularly surprising as I learned that these people are just the same age as me. Having this innovative, brilliant idea alone has already deserved big applause, and the fact that they set up this whole app by themselves using high-skilled computer science techniques is truly impressive. The two entrepreneurs were very smart in elaborating their ideas, especially when they try to aim at Gen Z as their consumers while studying the preferences and the needs of their generation.

Nevertheless, since the CEO is also GenZ, how can we make sure that their app is qualified enough to lead us on this path? The inexperienced and lack of knowledge in the field of the entrepreneurs themselves might limit the app’s features, resulting in the inability to access and delve deep enough into the investing section (we have to know that in the complex big stock market are many other risk factors that need to take into account, and this is not simply a game for young people). A thorough comprehension of the market and risks of the constantly changing environment is the most crucial thing to be considered while investing, and all of these numerous factors might be beyond what this app may cover. Also, another question is, does Gen Z people, really mature enough to take a risk with a business mind and invest money in the market by themselves?

For beginner investors, this new tool might serve as the best guidance and a great resource to build their foundation about the stock market. While there are challenges involved for Arjun and Raaga, I believe with further research and development, this app can grow further and attract more potential investors worldwide. It is essential for new investors to keep in mind that during the decision-making process, they should be ready to be equipped with additional knowledge and information to ensure a well-rounded understanding of the market they are entering.

Investing early allows you to adopt a long-term investment strategy, which can help mitigate short-term market fluctuations and volatility. By staying invested over the long term, you can ride out market downturns and potentially benefit from the overall upward trajectory of the markets. I feel that it is important to invest early and it’s also fun. I recommend doing the investment simulator to try it out with fake money before jumping into it with real money. I feel that the Minvest app is very needed because when I first started investing I had no idea where to start and I needed to go to different places to fine the information I needed. When you have one place that has everything you need it would be a lot easier to start investing. When I first learned about investing I didn’t know which account to open weather I should open a brokerage or a Roth IRA and I eventually found what the pros and cons were to both but it took a while since I had to use many sources due to not finding a credible source. You don’t need a lot of money to invest I started with 50 dollars and it turned into 80 and I used that money to invest again. I think that the app should help kids see that it’s not scary and once you jump into it it’s like a game. As Arjun said the reason why people are scared to invest is the risk but you can either try it and get outside of your comfort zone or make it less risky by investing in things other than stocks. I think anyone can be an investor and most people are. If you buy an iPhone believing it’s better quality and will last you longer, you are investing in that product. I definitely have more to learn and I’m sure this app will help me become a big investor.

I would like to thank both of you for starting Minvest. As a fellow investor (I started investing in the spring of 2022), I have witnessed the barriers you describe and I was told that there was only one way to make good investment decisions: spend countless hours pouring over earnings reports and attempting to understand the meaning of numerous financial ratios. Additionally, I learned that just looking at numbers and comparing them between similar companies wasn’t always enough to determine the superior investment. (For example, I remember seeing a company whose shares outstanding significantly increased and thinking it wasn’t a good company; however, this was because of a stock split and not because the company was selling shares.) Despite my efforts to improve as an investor, I lacked the confidence to invest because I was scared of losing money. I think Minvest can solve my problem. What I really like about Minvest is that it encompasses multiple aspects of investing and it is tailored towards someone with my level of experience. I feel that very few investing-research platforms that address fundamental analysis also care about ESG and are truly mission-driven. For Minvest, their commitment is to help the next generation build wealth. Many of my classmates who invest do so for this sole reason. They have seen older people benefit greatly from their investments and they hope to emulate them. Numerous studies have proven that investing is something that everyone should engage in to build long-term wealth. This is what really appealed to me about Minvest. Arjun, Raaga, and the rest of the Minvest team are Gen Z individuals who want to help the rest of Gen Z become better investors. They are not helping Gen Z as part of a larger initiative. I don’t think another company can rival Minvest’s authenticity.

I would suggest for Minvest to heavily focus on teaching fundamental analysis as it is the basis for long-term investing. I think that the One Minute Market detracts from this theme. I have personally spent many weeks analyzing companies before making my decision on whether or not I wanted to invest in them. I think that implementing videos is the best way to teach individuals about understanding the 3 financial statements, for example.

I think that Minvest has the potential to reach a countless number of individuals and it can really make a big difference in a lot of people’s lives. Having invested in the stock market, I can clearly see the value of the platform and I am confident in its ability to help Gen Z investors.

I really love the mission to get the youth (Gen Z) into finance and investing. While I’ve had experience investing and being involved with the stock market, I know most if not all of my friends do not invest. Despite this, I know that our generation has experience with work and making money, however I believe that investing has been neglected. This is why I love Arjun and Raaga not only bringing attention to, but a platform in which young people can invest at an early age to reap the maximum benefits.

Hi Sean! Definitely check out our Wharton High School Investment competition. You and your friends might want to form a team and begin learning about investing. https://globalyouth.wharton.upenn.edu/investment-competition/

Reading the article reminded me of my early experience with investing, when I started using practice sites and apps. It was both enjoyable and confusing, as I lacked an understanding of the process of investing, and the available resources proved too complicated for me to understand.

Using those investing simulations was a great way to explore investing without the fear of making mistakes. However, understanding the complexities of investing and finding beginner-friendly resources was quite challenging. The information I came across was filled with advanced vocabulary and tailored for experienced investors, making it difficult for me as a novice to grasp.

That’s why Minvest caught my attention in the article. It aims to provide clear and accessible educational content, addressing the very issues I faced as a beginner. The app’s focus on risk management, long-term investing, and socially responsible investment aligns perfectly with my goals.

Learning about Minvest gives me hope and excitement as the app streamlines the investment process, putting the power of financial management in the hands of everyday people. I hope the app will provide simplified navigation and valuable information so it can empower users to make confident investing decisions. While I haven’t tried Minvest yet, it seems like an ideal platform for beginners like me.

The month is January, 2023, and my group of friends are about to make our first forays into investing by hosting a mini paper stock trading competition. Me, cocky and sure that I was about to make my Wall Street debut, put every last fake cent in Tesla stock. And promptly lost about $10 000 by the next day. Humbled, I quickly realized that stock trading is no place for teenagers. With an abundance of resources ranging from nonsense jargon to hour-long Youtube videos I have no patience for, I had absolutely no idea where to start with the basics. Thus, I gave up my journey to Wall Street stardom before it even began. Since then, I have relegated stock trading to a conversation around the adult dinner table; an unknowable art akin to rocket science.

Minvest, however, is the app that I wish I had and am glad that I now do–being created for teens by teens, it has all the features that matter. Although corporations have a reputation for superficiality and atrocious human rights violations, for example, the Minvest ESG rating provides users with the peace of mind that they are investing in society rather than a company. While the app may not be perfect (the One Minute Market, for one, encourages quick-fire decisions instead of a deep understanding of each stock), it is exactly what teenagers need. If not to teach you healthy financial decisions, then at the very least to avoid putting your entire savings account into Tesla stock.

Unfortunately, you and I have had a similar experience when it comes to our first time trading. When I was younger, the Gifted and Talented program at my school ran a stock trading competition. My team and I had no idea what we were doing or where to start, and our money quickly dwindled. As I’ve grown older, my parents have tried to convince me start investing, yet the time and effort it takes combined with the potential risks draw me away from it. In addition, the stock market is stigmatized as for white-collar middle aged men, so most teens typically don’t even try to enter it. It’s written off as something we cannot understand, which is untrue. This is why Minvest is so great. It makes it very easy to understand the numbers and gives an overview of a stock.

Truthfully, I tend to be a skeptical person. This is common in today’s world where we never know what is fact or fiction on the internet. I think that could be an asset in using this app, though. A 1-minute overview will pique my interest in a stock, and I can do my own further research. This also helps make sure I am not investing too much or too little. Minvest can be a great gateway into the world of finance and stock trading.

To your point, Emily, I also love the ESG feature. There is a saying that “there are no ethical billionaires,” which can turn people away from big companies without a second thought. They don’t want to support companies that aren’t supporting the world. The ESG feature can make sure teens are investing in companies that they believe in not only from the numbers, but ethically. This is an especially important value in Gen Z. I believe Minvest can significantly increase the amount of young investors, and I know I would love to try it.

Financial literacy is dwindling in the United States. FINRA found that just 34% of Americans could answer four of five basic financial literacy questions. This rate was a decrease of 8% from just a decade earlier, and the largest decrease occurred in Americans in the 18–34 age range. With these numbers in mind, financial literacy could be represented by an even lower number than 34% for kids who are coming out of high school.

The work which Minvest does is phenomenal in helping make one part of financial literacy simple- investing. I’d like to share my story with the investment club that I started at my school in Frisco, TX.

In addition to learning about investing, our mission is to teach high schoolers about the finance field and other concepts regarding finance with emphasis on investing. Learning real-world applications to concepts learned in math, statistics and economics, connecting between the past (historical events), present (news), and future (planning), and understanding money are some of the concepts that we push forward. Arjun’s ideas of long-term investing and investing with a purpose is also an idea which my club in TX has embraced.

I have a personal portfolio in which I invested the money I earned from my work at Kumon as a tutor. I am also thankful for learning about investing so early from my parents. The FINRA statistics showed me that there was a need for a club like mine. To address this need, I brought together three of my friends at the beginning of the school year to start the club with me, and I’m happy to say that it’s taken off. We had 40 members in year one, and we are still looking to expand further. In 2 global competitions, including Wharton’s HS investment competition mentioned in the article, we were finalists as well. Our club made a positive difference in our community as well, donating 30 toys in our holiday toy drive.

Empowering high schoolers to invest early with real money is also part of what we do. Some of our club members have started their own personal portfolios. We also had one of Forbes’s top financial security professionals, Ashvin Chheda be a guest speaker at our meeting.

All in all, everyone in the club learned something. Doing competitions, especially Wharton’s, we learned a lot about investing. All of the other factors, such as the 2 competitions, amount of members and toys donated, etc. are only possible because we were able to learn from each other and use each others’ ideas.

The story which Arjun and Raga share holds a special place to me because the passion that both of them have is similar to what I want to create with my investment club. Who knows, we might use Minvest next year to teach our members stock research 🙂

These two students’ investing experiences teaches me a lot. I wanted to invest many years ago, but I always gave up because I was afraid of risking losing money. From Arjun’s words, fearing of risks shouldn’t make us stop investing. Instead, it should not only let us think about the profits but also try to minimize risks.

Investing doesn’t mean gambling. It requires us to master economic knowledge and contemporary information, such as economic trend and certain fields’ prospects, especially when we are planning to purchase stocks. In this sense, investing is very complicated, and we need strong abilities to analyze and make decisions.

In my opinion, Minvest is a fantastic app which gives us chances to learn about finance and exercise our abilities such as risk management. When we start to do investments in the real world, we have acquired much experience.

This article is eye-opening. Minvest is even more fascinating, pulling at your heartstrings to uncover more about why investing exists and how it can alter the future of your business world. “The very risky and short-term investing mindset is actually the exact reason why so many people don’t invest,” as Arjun once said in this article. I feel that his quote explains so many of the things we fear: boredom, a sense of not knowing, fear itself from losing thousands of dollars when investing, and other miniscule reasons that are just there to prevent us from doing what we want. Thus, Minvest is there to not only teach future generations to create a more profitable and bright future, but one that teaches them the essentials of fighting that tug inside us that lures us to seeking the comfort of social media, video gaming, and binge-watching Netflix. I do not agree that these activities are entirely harmful, but I think that an excessive amount of anything can result in two entirely opposite directions. While Minvest is an app, it is also a self-learning center. I cannot wait to see how Minvest teaches not only future entrepreneurs and employees to take charge in their finances, but forces them to act in a positive manner that fights this boredom we are all so afraid to face.

In the podcast, Arjun says “In fact, it makes me think of one of the interviews [I had with a student] earlier. I said, what’s the first thing that comes to your mind when you hear the word investing. They said, numbers flying all over the screen, and people making trades super quickly and lines flying everywhere. Obviously, there are a lot of things wrong with that answer. But one thing that it really highlights is how the short-term investing mindset has almost been a poison that’s preventing so many people from investing.”

I deeply align with Arjun’s perspective on this topic, and I am inspired by the Minvest team on how they were able to identify the major hurdle of short-term investing that Gen Z faces, then were able to create a product that is so specifically tailored to our needs that it virtually solves the entire problem, all while sticking true to their passions. The glorified notion of short-term investing, referred to as the “get-rich-quick mindset” by Mrs. Drake, is detrimental for Gen Z when it comes to getting involved in investing. Like Arjun mentioned, many people have this image of someone in front of multiple screens with flashy graphs, making quick money every minute. However, investing doesn’t have to be that complex for most individuals. Nonetheless, it’s important for members of Gen Z to understand that investing is not a path to instant wealth. Instead, it offers a means to secure a comfortable retirement or provide financial support for their future children’s education.

I agree with Minvest’s strategy to counter the prevailing mindset of short-term investing by explicitly outlining the risk associated with each stock. By providing comprehensive information, including the risk profile of every stock, and presenting it in easily understandable “bite-sized” format, Minvest not only helps people understand the advantages of long-term investing but also enables them to apply this knowledge while considering the assessed level of risk. This approach is undoubtedly the most effective method I have encountered to tackle this trend of short-term investment.

Understanding the level of risk associated with a particular stock can be challenging, especially for beginner investors like myself. Without proper knowledge and guidance, it’s easy to accidentally choose high-risk stocks, potentially jeopardizing long-term investment goals. I remember when I first started investing during my freshman year. While I had heard about the concept of long-term investing, I lacked practical know-how in assessing risk accurately. I understood the general idea of picking safer options but struggled to identify truly secure investments. Questions like “How do I effectively evaluate a stock’s risk?” plagued my mind. In search of clarity, I followed the common advice of “buy low, sell high,” hoping that by adhering to this mantra, success would naturally follow. Unaware at the time, I made an assumption that prominent companies were always safe investments and decided to invest all my money in Macy’s due to its apparent low performance on the stock market, as I was aiming to buy low and sell high. With great anticipation for long-term growth, I held onto my shares without fully understanding what long-term investing truly entailed. Unfortunately, Macy’s failed to recover and continues to face considerable challenges even today. Looking back on my novice investment decisions now reveals the importance of being able to properly assess the risk of a stock in order to actually invest for the long-term. But then again, how can we expect novices to be able to preform such an evaluation so early in their investing careers?

That’s why Minvest is an invaluable resource for promoting long-term investing. It not only educates people about the principles of long-term investing but also provides them with a risk analysis called “beta.” This way, users who are interested in investing for the long haul can make informed decisions based on pre-analyzed risk. By teaching the advantages of long-term investment and offering risk assessments, Minvest encourages individuals to prioritize long-term growth and avoid the pitfalls I experienced myself.

In the first 30 episodes of our future the business world prodcast, we have yet to dedicate an entire discussion to investing

This article is eye-opening. Minvest is even more fascinating, pulling at your heartstrings to uncover more about why investing exists and how it can alter the future of your business world. “The very risky and short-term investing mindset is actually the exact reason why so many people don’t invest,” as Arjun once said in this article. I feel that his quote explains so many of the things we fear: boredom, a sense of not knowing, fear itself from losing thousands of dollars when investing, and other miniscule reasons that are just there to prevent us from doing what we want. Thus, Minvest is there to not only teach future generations to create a more profitable and bright future, but one that teaches them the essentials of fighting that tug inside us that lures us to seeking the comfort of social media, video gaming, and binge-watching Netflix. I do not agree that these activities are entirely harmful, but I think that an excessive amount of anything can result in two entirely opposite directions. While Minvest is an app, it is also a self-learning center. I cannot wait to see how Minvest teaches not only future entrepreneurs and employees to take charge in their finances, but forces them to act in a positive manner that fights this boredom we are all so afraid to face.

I deeply align with Arjun’s perspective on this topic, and I am inspired by the Minvest team on how they were able to identify the major hurdle of short-term investing that Gen Z faces, then were able to create a product that is so specifically tailored to our needs that it virtually solves the entire problem, all while sticking true to their passions. The¬ glorified notion of short-term investing, referred to as the¬ “get-rich-quick mindset” by Mrs. Drake, is detrimental for Gen Z when it comes to getting involved in investing. Like Arjun mentioned, many people have this image of someone in front of multiple screens with flashy graphs, making quick money every minute. However, investing doesn’t have to be that complex for most individuals. Nonetheless, it’s important for members of Gen Z to understand that inve-sting is not a path to instant wealth. Instead, it offers a means to secure a comfortable retirement or provide financial support for their future children’s education.

I agree with Minvest’s strategy to counter the prevailing mindset of short-term investing by explicitly outlining the risk associated with each stock. By providing comprehensive information, including the risk profile of every stock, and presenting it in easily understandable “bite-sized” format, Minvest not only he¬lps people understand the advantages of long-term inve-sting but also enables them to apply this knowledge while considering the assessed level of risk. This approach is undoubtedly the most effective method I have encountered to tackle this trend of short-term investment.

It’s fascinating to see how Arjun Setty and Raaga Kodali are taking an iterative approach to simplify investing for their generation through their app and online platform. Engaging young investors in the investing-research process is a crucial step toward making it more accessible.

Like many Gen-Z, quick-form media like TikTok and Instagram have been in my daily life; I’m constantly attracted by the algorithms that are designed to grab my attention. Likewise what initially caught my eye in Minvest was the “One Minute Market”: an innovative tool that educates a user about a company in under one minute, catering to Gen-Z’s quick attention span and making investing easier. Listening to Arjun’s and Raaga’s experiences, I resonated with some of their struggles when I led my team to compete in Wharton’s Youth Investment Competition last fall. I faced the same challenges when trying to educate my inexperienced teammates about choosing the right company and building a portfolio. A company’s quarterly earnings are important, but creating a long-term portfolio also means investing in sustainable and ethical business practices. Most of my teammates did not understand the concept of long-term investing and struggled to understand the complex numbers under the statistics tab. The process was overwhelming for everyone to grasp. I also felt entirely lost.

However, mulling over my investing journey, I was more fond of growing with the companies I invested in to form a long-term investment; which ironically, was a different approach from the “One Minute Market” promoted by Minvest. Starting from a hobby of electronics and computers, in 5th grade, I was obsessed with building my first PC. After spending hours studying different components and aesthetics, it became clear that Nvidia’s GeForce and AMD’s Radeon were the two main powerhouses in GPU (Graphic Processing Unit) manufacturing. Since GeForce consistently outperformed Radeon in graphical rendering and performance; in that instant, it was forever ingrained in my mind that Nvidia’s GeForce was the de facto GPU, sought after by professionals and recreational use. Justifying the premium price compared to Radeon.

Hooked on Nvidia’s products, my 5th-grade end-of-year stock pitch in math class was centered around Nvidia, a medium-sized PC hardware company at the time. GPUs still lacked real professional use besides gaming and rendering in 3D software. However nowadays, with the surge in the power of AI (Artificial Intelligence), and cryptocurrency; GPUs (mainly Nvidia’s) are utilized to enhance the parallel computing power so computers can be pushed harder to generate new blockchains or crunch more data. Since my initial introduction to the company in 5th grade, Nvidia’s stock has grown over 2,500% and is becoming one of the biggest companies in the world. As Nvidia grew, I did too as an investor.

Nvidia was the first company that I invested in, and my interest in gaming and computational power kept me along for the ride. However, it was not always smooth sailing; at one point, Nvidia stock dropped almost 50% from my initial investment, causing me to lose faith in the company and consider selling my stake. Nevertheless, I still believed that Nvidia was building the best GPU in the market, and during the downturn, I started to learn everything about Nvidia’s business. As cryptocurrency emerged, I was fascinated by the role that GPUs played in creating the blockchain-based digital currency. When foreign trade policies intervened in Nvidia’s sale, I learned more about how heavily a government can suppress or catalyze a global company in its export capability. Following Nvidia’s ups and downs over the past five years, Nvidia proved to be an outstanding and resilient company to face different challenges. It also taught me the various factors that can directly impact a company’s fate. The journey allows me to become more knowledgeable about the company and industry.

In hindsight, the investment knowledge is accumulated through consistent learning and seeking answers. The investing journey is a long process, and often with ups and downs along the way. Somehow, it is anti-intuitive that you might need to maintain the interest as most other investors have lost their faith. In the modern digital age, Minvest is indispensable in introducing young investors to stocks; the bite-size information is supplied to teens within their quick attention spans to make learning to invest easier. Yet, to keep them continually investing, there should be a link to bridge their keen interest, their belief in a company, and logical thinking; something that they have to spark on their own time as an investor.

This project attracted me because I identified with the problem they are trying to solve. Investing is not easy, especially when you are young, and in some cases, unfortunately uninformed. Arjun’s and Raaga’s work to solve the excuses of lack of time, fear of risk, and limited education, is perfect to give Gen Z that push of motivation and education to bring awareness on investing and secure ways to do it. Aside from this, their focus on ESG analyses was astounding to me, this gives me the impression that their platform is an agent of change that aims to change how we think and do investments. As I began investing not so long ago, I felt that sense of disorientation, not knowing which companies were the most profitable that simultaneously had an environmental or social cause. While my parent’s help was crucial in this process, as well as my research, I believe platforms like Minvest, can evolve in optimistic ways to make this process even easier, especially for teenagers. The first example is to offer consults, or real-time meetings with Gen Z clients who are interested in beginning their investing journey, offering them guidance through their first steps. Another idea is to make collaborations with banks or other platforms in which they can apply what they have learned and make their first inversion. One of the fears that comes to the mind of someone who is a beginner in the investing world, is where to invest. We find thousands of articles that help us understand how inversions work, yet very few partner with, or recommend investing sites that can guarantee you security and guidance. Because of this, partnering with well-known investing platforms, or banks, could be a great addition to Minvest. My third proposal for Minvest is regarding public policy and education. One of the most effective ways to share their purpose and reach their goal to educate Gen Z on investing and the mindset that is required for success in this field is through educational programs in schools offered to young kids. Minvest can propose their educational purpose to educational centers and make campaigns to educate young people on how investing works, why should we invest, what are the company’s responsibilities to shareholders, how to invest responsibly, why demand for ESG analyses, and finally, educate people on how investing is a long-term matter, that requires time and patience, as well as fearlessness. With this, I believe that Minvest can grow into a great organization by the youth for the youth, making it easier for teenagers to explore the world of investing with more security and endowed with all the knowledge and tools necessary to succeed in this world.

Minvest’s approach to simplifying investing research for Gen Z is impressive. To enhance its usability, integrating a feature that educates users on long-term investment strategies and risks could help shift the focus from quick gains to sustainable growth. Additionally, incorporating real-time market analysis powered by AI can provide users with up-to-date insights, making informed decisions easier. These enhancements can ensure that Minvest not only makes investing accessible but also promotes smart and responsible investment habits among young investors. AI-powered market analysis can push young investors to make safer and more stable trades. AI’s path while analyzing the market can be explained step by step to the user so they can learn from it.

Well, the only problem with AI-powered market analysis is that it is built upon a very hands-on approach. AI-guided or not, you are steered towards safer trades with this system. These relatively stable trades will not lose you money but will not make you wealthy in your teens either. While the actual “insane profits” that you hear in the news are made by the riskiest of trades, these safer ones are often overlooked because of their relatively low ROI in comparison. Plus, trading in these safe waters will never teach you the high-stress, risk, and tension trading environments like those on Wall Street. Think of it this way: you can always use training wheels on your bike, but you will never know how to ride without them unless you take them off and risk bruising your knee. The higher the risk, the higher the reward, and everyone knows that.

To address this issue, Minvest could introduce a simulated trading environment where users can engage in high-risk trades without real financial consequences. This would allow young investors to experience the stress and decision-making processes of high-risk trading while still learning from their mistakes in a safe space. By combining this simulation with the AI-powered analysis of real trades, users can gain a well-rounded understanding of both safe and risky investment strategies. In essence, Minvest would offer the training wheels for those just starting, but also the opportunity to take them off and ride freely, preparing young investors for the real-world market while minimizing potential losses.

When I first heard the term “investing,” I imagined a black background, with neon green dollar signs, numbers, and charts rushing around a screen. Even with experience in investing, the image stuck with me: investing meant quick trades with the intention of quick profits. However, over time, and through hearing what Arjun had to say in this podcast, I’ve realized how Gen Z is redefining investing. Arjun highlights this trend by pointing out how Minivest is “made by Gen Z for Gen Z,” which emphasizes personalization based on the values many young investors care about. Instead of solely pursuing wealth accumulation, Gen Z aims for transparency and social accountability from the companies we invest in. This shift indicates growing emphasis on ethical values, where financial return and social impact are no longer separate.

Increasingly, my generation has started asking questions that others didn’t always consider: Does this company treat its workers fairly? What’s their environmental impact? Are they positively impacting the world, or just making profits at our expense? This mindset shift can likely be accredited to all the information we’re surrounded by. Whether it’s climate change, inequality, or corruption, we refuse to ignore these realities to make a quick buck. In fact, profit and positive impact can go hand in hand. Tools like Environmental, Social, and Governance (ESG) ratings, though imperfect, allow us to weigh financial returns alongside socio-environmental impact. Instead of solely focusing on building wealth, these tools are paving the way for young investors to seek corporate accountability and responsibility.

Hearing young voices talk about investing through this lens made it feel more human, and more relevant to my own goals. It reminded me that finance isn’t just about numbers. Instead, it’s about values, choices, and long-term impact. As Gen Z continues entering the financial world, I believe we’ll continue challenging the idea that success is only measured in profits. We want our money to mean something, which might be the most powerful investment of all.

I think the “Five Why’s” approach is great for product development and regular life when we want to solve a problem. It really makes people think and figure out the root issue. Without fully understanding what problem you’re tackling, it probably won’t work. Steve Jobs had this ability to understand people’s needs before they did. That’s why Apple scored such phenomenal success. He knew exactly why he was building something and what issue from people’s lives it would fix. I believe that’s why Minvest came out so successful too. As Raaga said, they didn’t expect this, but through deep analysis and understanding of Gen Z problems, they turned Minvest into a great project. For instance, when they realized they weren’t graphic designers or needed marketing help, they found peers in their school who could handle it.

I’ve heard of products that could’ve sold well but, because the founders didn’t release an MVP or use an iterative approach to fix issues, they rushed the final version and failed. It’s great to see Minvest patiently working on their product, improving it steadily without rushing or neglecting continuous feedback. They see the bigger picture, planning for years instead of weeks or months, which in my opinion reflects perfect leader traits and a foundation for future CEOs with their strategic mindset.

I’ve been investing for three years now, and it took lots of time and effort to learn to become profitable, but many of my friends and my peers have similar view on investing like thos interviewed by Arjun. They say it’s too complicated and time-consuming to learn, so they’d rather avoid risking money. Many don’t know where to start. I’m sure Minvest would help lots of people since it makes trading friendly, not too time-consuming, and offers a clear starting point. While I’d use it for a quick company overview, I prefer deep fundamental analysis for informed and smart decisions. Nevertheless, many Gen Z folks aren’t into finance, and investing is a small part of their lives, so instead of spending countless hours trying to understand the basics, Minvest lets them jump in early and have fun.

I was 14 when I discovered the world of stocks. Hopefully, I bought shares of companies that were well-known and trending. There was only a strong desire to earn money quickly and a belief that equities would rise. Fortunately, after one year, I made a profit, and it was as I personally expected. But now, I understand that it was just luck.

In Kazakhstan in 2024, there were only few bloggers who talked about financial literacy. No educational apps existed, and even brokerage platforms were rare. If only I had had a platform like Minvest, I would have gained confidence in making investments decisions much earlier and avoided confusion and hesitation.

I am passionate about your platform and its positive impact in the financial sphere. However, there is one thing I would like to suggest. Arjun said that they are offering a ready set of stocks tailored to a user: “For instance, if you’re someone who’s very low risk, then [it would] recommend stocks with something called a lower beta to you, which are just lower-risk stocks.” From my point of view, that is not necessary, especially when fostering long-term investing. The platform should aim to implement a self-education system. An individual should understand a purpose of each purchase and a reason for choosing a particular stock. Then, If investors face a crisis, they will already know that their companies are fundamentally strong and that a market downturn is temporary. As a result, the will not panic and sell their shares during a bear market.

As Amogh A. said, the platform needs educational content: “I think that implementing videos is the best way to teach individuals about understanding the 3 financial statements, for example.” I absolutely agree with his opinion. It is the only way to understand the market and properly manage a portfolio in the future.

Some might argue that investors do not have the time to deeply study securities. But in this case,an investor becomes just a shareholder. Investing requires intention, not just ownership.

I wish Minvest would grow into a major company that builds a global social platform for Gen Z investors, empowering them to invest correctly and with confidence. Thanks for reading!

Investing can feel hard and intimidating, especially when you’re just starting out. That’s why I found the idea behind Minvest so helpful for Gen Z.

I especially liked the One Minute Market concept that turns hours of research into one-minute insights which is exactly what our generation needs, especially since many of us struggle with short attention spans.

However, I wonder how much you can actually learn about a company in just one minute, and whether the summaries include all the critical information needed to make a smart investment decision.

I also think if Minvest added a section where users could anonymously share their quick takes or questions on the same company it could make investing feel more social, relatable, and less intimidating.

Overall, I appreciate how Minvest is helping build a more financially educated and empowered generation of investors.

Hi Arjun and Raaga,

Your story instantly brought me back to my first investment competition, the Ithaca College High School Investment Competition. My three teammates and I had zero experience trading, just paper money, and even less education. We learned from YouTube videos, and my dad taught me about market cap and spotting fast growers. I developed a habit of “sniping” earnings reports using company news and community feedback, and at one point, we reached 150% of our original value. But then tariffs hit, and overnight we dropped to 116% and lost the competition. That single event taught me more about macroeconomic forces than any video could.

Reading about Minvest, I saw our journey in your mission. We struggled with the same barriers you described, lack of time and limited education, and your One Minute Market and bite-sized content could have helped us make better, faster picks. But what really stood out to me was realizing our biggest gap wasn’t buying, it was selling. We were fully invested at all times and never had an exit strategy. I think Minvest could be even more powerful if it included selling-plan guides alongside buying suggestions.

Your approach to simplifying investing for Gen Z makes me wish we had Minvest during our competition. I’m excited to see how you keep refining your platform, because tools like yours could turn more first-time traders into informed investors who can handle both the highs and the inevitable lows.