Corporate Strategy and How to Shape an M&A Success Story

Let’s start with food – specifically, snacks.

Many of you probably tore into a bag of candy M&Ms in recent weeks, or perhaps you popped open a can of neatly stacked Pringles potato chips to feed your urge to munch. Simple acts in the life of a snacker, right?

So much more complex in the world of business. Mars, the company that makes M&Ms, recently announced that it was buying Kellanova, the company that makes Pringles. Sweet meets savory in a $36 billion purchase.

This is but one megadeal in the landscape of mergers and acquisitions (M&As), transactions where two or more businesses consolidate their ownership and operations. Dr. Emilie Feldman, a management professor at the Wharton School of the University of Pennsylvania, who has researched and taught M&As since joining Wharton more than 13 years ago, thinks about these types of deals daily.

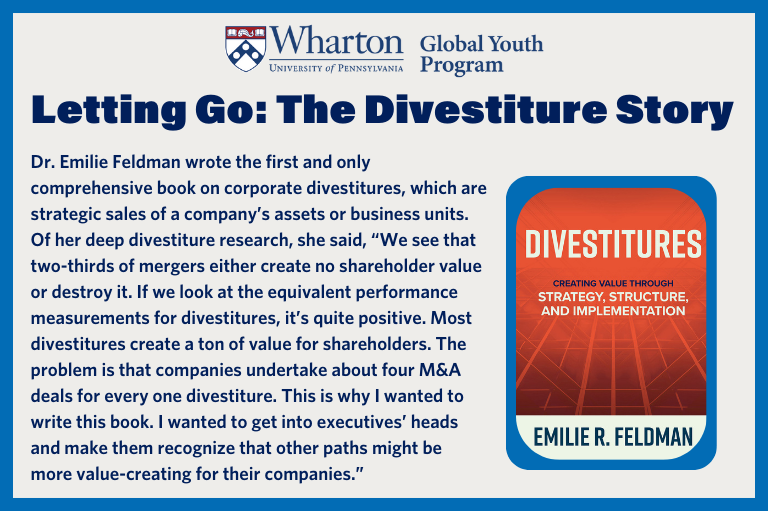

“Mergers and acquisitions are when two companies come together,” notes Feldman, who adds that macroeconomic factors like interest rates and inflation can impact the volume of and appetite for M&A deals. “Specifically, one company might buy another, or there might be an exchange, so they come together and create one entity from two…Corporate strategy has to do with where we set the boundaries of a company. So, do we expand by doing mergers and acquisitions, or do we want to reduce our boundaries, for example, by removing certain businesses? That’s what I’ll refer to as a divestiture.”

Dr. Feldman, who published the book Divestitures: Creating Value Through Strategy, Structure and Implementation (McGraw Hill, 2023), recently shared her insight on corporate strategy and M&As with high school students attending Wharton Global Youth’s on-campus summer programs.

A Framework of Four

In cases like Mars and Kellanova, or the example Feldman highlighted in her lecture of the Chobani yogurt company buying La Colombe coffee company in 2023 for $900 million, companies must think through essential issues when evaluating potential M&A deals. These include synergies, access to new markets and customers, technology integration and cultural fit. “There are a lot of considerations we have to think very carefully about in understanding what merger and acquisition transactions are and [how] to make them successful,” noted Feldman, adding that many M&A deals fail to create value, often due to overstating synergies, paying too high a price and poor post-merger integration.

Feldman presented the following framework to guide companies (and future M&A execs) as they ponder expanding through mergers and acquisitions:

✅ The objective: Why are you doing the deal? Fundamental to the ultimate success of a deal, stressed Dr. Feldman, is to identify areas where the two companies can create value together that they couldn’t achieve separately. These objectives might involve vertical integration, when the company’s supply chain is integrated and owned by the company; related diversification, or expansion into similar markets; and unrelated diversification, where a deal helps a company enter an entirely new industry. She pointed to online retailer Amazon buying Whole Foods health-food market as one example of a deal with lots of cross-pollination, including leveraging Amazon’s logistical expertise for a chain of markets, moving into physical retail, and increasing revenues.

✅ Due diligence: What are you buying? Due diligence, noted Dr. Feldman, is about deeply understanding the target company — its strengths, weaknesses and how it would integrate into the existing company. “There’s a whole list of issues and questions to think about when you’re doing due diligence,” she said. “Customers, markets, supply chains, suppliers, executive teams, technology, competition. Due diligence is a very comprehensive exercise to think about what you’re getting, is it valuable in and of itself, and how are you going to make it more valuable given the context of your own company?”

✅ Value proposition: How much should you pay for it? Don’t just focus on a number, noted Professor Feldman, but instead carefully assess the value of an acquisition target. In the case of Facebook acquiring WhatsApp, she asked: was $90 billion a fair price? “We have to think about [the company’s growth potential] as a key driver,” said Dr. Feldman. “Even if WhatsApp is not that valuable, not that big [on its own], maybe there are other markets, or other areas that we could expand into that might make it worth that kind of price tag…Part of it is market access, part of it is growth potential, part of it is customers and thinking about the alternative scenario” of another company possibly the acquisition deal – should you eliminate that competitive threat.

✅ Working together: How should you address post-merger integration? When it comes to the values, beliefs and behaviors that define how a company operates, the cultural differences between acquiring and target companies are often underestimated, noted Professor Feldman. “Post-merger integration is a big issue,” she stressed, pointing to Unilever’s acquisition of the ice cream company Ben & Jerry’s for $326 million in 2000. Unilever is now considering divesting the company and spinning off its entire ice cream portfolio. Among the challenges for these two very different corporate cultures: a unique business ethos led by Ben & Jerry’s strong social activism compared to Unilever’s more traditional corporate approach; different operational processes related to pay structures and production priorities; and the importance of preserving brand identity, which could be tricky when a giant consumer goods company like Unilever takes over a smaller, niche player like Ben & Jerry’s. “You can imagine a lot of differences here in terms of how these two companies are managed and how they’re led,” added Dr. Feldman.

M&A, concluded Professor Feldman, while a core part of corporate strategy, can have its challenges. Careful analysis and integration are critical to success. Want to dig a little deeper into Dr. Feldman’s research? Listen to this Wharton Business Daily podcast.

Hero Image Photo Credit: Jeshoots.com

While Dr. Feldman’s 4 step framework will help you become a savvy M&A manager, these same steps can be applied to other aspects of our lives. How so?

What is a divestiture?

Have you had any personal experience in the M&A world? Share your story in the comment section of this article.

The articles tood out to me because it highlights something I experience daily in corporate law: how M&A transactions go far beyond financial modeling. Strategic integration, cultural alignment, and clear communication between teams are just as critical as valuation or contractual terms.

Even as a trainee, I had the opportunity to structure a corporation (S.A.) designed for future dual listing a project that required strategic thinking from the corporate design phase through to regulatory and governance implications. So when the article emphasizes the importance of aligning corporate structure with strategic intent, I immediately saw a connection with the challenges I faced in building something solid, functional, and capable of being accepted both internally and by regulators.

Another point that struck me was the emphasis on clarity of purpose not only during the deal, but especially post-transaction. In practice, I often see how that “post-deal” phase is underestimated, which is exactly where integration failures and communication breakdowns tend to happen. Seeing this addressed from the beginning as part of the corporate strategy shows maturity and realism.

In summary, the article reinforced something I’ve been learning through hands-on experience: working in corporate law today requires approaching M&A with a strategic and multidisciplinary mindset. It’s not just about understanding the legal structure it’s about having business awareness, anticipating long-term risks, and recognizing how today’s decisions shape the success of a transaction in the future.

Carolina, your corporate law experience is the perfect example of how M&A is a cross-functional activity—legal, financial, cultural.

To follow up on your observation: did your deal team employ governance-by-design structures in deal design—where cultural points of integration and communication protocols are built contractually or through oversight committees? In my nonprofit integration project, we used role-alignment charters prior to onboarding, which cut misunderstanding by 40%. Incorporating that type of clarity up front has the power to shift post-merger dynamics.

I would love to know how legal departments reconcile rigorous contract structures with the soft machinery of integration—such as tone-setting, shared leadership, and informal feedback mechanisms—while meeting regulatory requirements.

Dr. Feldman’s four-step M&A model—defining objectives, thorough due diligence, valuing synergies over price, and post-merger integration—is what transforms these transactions into strategic transformations. The Mars–Kellanova megadeal is a classic case in point, and analysis in the article on culture clashes (e.g., Unilever and Ben & Jerry’s) adds a welcome human dimension to M&A.

Objective clarity is vital—without it, strategic misalignment undermines long-term value unless you’re aware of whether you’re pursuing vertical integration, related diversification, or venturing into new industries. During my AWS/SQL fintech internship, we treated feature releases as mini-M&A deals: defining a clear objective (e.g., move into SMS onboarding), checking technical feasibility, projecting ROI—and only then building it. That disciplined process landed us a 15% conversion increase in our pilot.

Due diligence isn’t skin-deep. It encompasses culture, governance structures, and supply-chain sustainability. In my nonprofit experience working at Bhoomika Trust, we did not just evaluate potential partners on budgets but on mission alignment and operational readiness. That kind of whole-person vetting is what Dr. Feldman describes—and where so many high-stakes mergers fail.

Valuation is about more than price. Facebook buying WhatsApp proves that the premium is being paid for scale, user stickiness, and future scale. Priced in an AWS and Python fintech prototype I built, we priced new features not just based on development cost but on projected user lifetime value—routing product prioritization and investment strategy rather than going after feature parity.

Post-merger integration (PMI)—cultural misalignment kills deals faster than overpayment. Ben & Jerry’s-Unilever example illustrates how institutional values decide fate. We saw the same when integrating a donor management tool into our practices: invisibility within roles and leadership alignment slowed adoption. Incorporating ritualized onboarding processes, shared values workshops, and feedback loops assisted in streamlining integration and efficacy.

A strategic question for the community: For cash-starved midsize companies following the deal, are there agile PMI architectures—like phased integration pods, culture alignment sprints, or value-area navigators—that can fuel synergy without drowning workers?

This article masterfully reframes M&A as an end-to-end strategy exercise—from original intent through ultimate integration. A must-read for next-generation business leaders: deals don’t create size—they require discipline, vision, and organizational empathy.

The Mars-Kellanova deal highlights why most M&A fails at cultural integration. Executives nail financial due diligence but miss operational friction that kills deals post-close.

Dr. Feldman’s Ben & Jerry’s example proves this. Unilever mastered the numbers but missed how activist culture would clash with corporate hierarchy. Result? Considering divestiture after 24 years.

Cultural due diligence needs the same rigor as financial analysis. Companies should map decision-making processes before signing. Soft costs of misalignment rarely show up in valuations but consistently destroy projected synergies.

The real question: can a candy company’s rapid innovation cycles mesh with a snack giant’s supply chain without creating internal gridlock?

Do you like M&M’s? Do you like Pringles? How about a combination of both?

Last August, the company Mars Inc. announced that it was acquiring Kellanova, a deal bringing the famous M&M’s and Pringles chips together. From the customers’ perspective, the acquisition may seem like a brilliant takeover, as together, the two companies would offer products across numerous markets in the consumer staples sector, from chocolate bars to dog food and from chips to cereal. However, this deal has not yet been closed. Recently, on June 25th, US antitrust regulators approved the acquisition. In contrast, the European Union launched an “in-depth investigation” due to concerns that the deal would raise prices and contribute to food inflation.

Introduced by Senator John Sherman in 1890, the first antitrust laws were established more than 130 years ago. Their purpose is to protect customers from being exploited by companies that attempt to transform into monopolies and prevent them from engaging in malpractice. Without antitrust laws, we could imagine that most markets would suffer from a lack of competition, resulting in a narrower range of products and services being offered to customers.

We can also closely analyze the impact of acquisition from an economic perspective. If a company gains a notable amount of market share, it could result in a drastic increase in the price of its products, and we, as customers, would be faced with much fewer options to choose from but a much higher price to pay. What are the possible outcomes? Consumers may either refrain from buying the products due to the staggering prices, or the sudden increase in costs could result in stockpiling – buying more of the products in advance because customers are afraid that prices will soar even higher. Sadly, neither scenario contributes to a stable economy.

Now, let us swing back to Mars and Kellanova’s acquisition case. The US Federal Trade Commission approved the deal, stating that “there was no violation of American law that can be proven in court.” This decision concluded that there was limited product overlap between the two companies, bringing no direct harm to buyers.

After Mars Inc. and Kellanova obtained 27 of the 28 required regulatory clearances, the verdict of the European Commission is the only pending decision. Unlike the US antitrust regulators, the European Union takes into careful consideration that the acquisition could aid Mars Inc. in profiting from the “portfolio-effect.” More specially, the EU is concerned that if the acquisition were approved, Mars Inc’s portfolio of brands would expand significantly, resulting in increased pressure on retailers to accept higher prices, ultimately leading to higher costs for consumers. Furthermore, food inflation continues to be a major issue in Europe. As Teresa Ribera, Executive Vice-President for a Clean, Just and Competitive Transition, European Commission, stated: “It is essential to ensure that this acquisition does not further drive up the cost of shopping baskets.” By October 31st, 2025, the European Commission is expected to make a decision regarding the acquisition.

As a customer and snack lover, I support the approval of this acquisition because the products offered by both companies are not in the same market, meaning that the acquisition would not lead to the dominance of either Mars Inc. or Kellanova in any market. Instead, this acquisition would increase their overall market share to an estimated 25% of major snack segments across Europe, allowing the two companies to compete with the current top snack companies in the European market, including PepsiCo and Nestlé. Although there are concerns about Mars Inc. profiting from the portfolio effect due to its expansion of brands, it is worth noting that its competitors also own a broad range of popular food and beverage brands. From my standpoint, this acquisition would benefit both Mars Inc. and Kellanova in advancing in the snacks and candy market; meanwhile, it poses no direct threat to customers, does not risk the formation of a monopoly, and does not breach antitrust laws.

I’m positive for the new M&M’s flavored Pringles chips. Are you?

I’m also optimistic about this deal Angelina, but for a reason that goes beyond just product diversity or market share. What really stood out to me in Dr. Feldman’s framework, especially her point about defining the objectives, is that M&A is starting to evolve from a tool for expansion into a strategy for adapting how a company thinks and operates. That’s the part of this Mars–Kellanova merger that I find most interesting.

When people talk about M&A, they usually focus on either cost-cutting or new revenue streams. But in this case, I think the value lies in something more subtle: the opportunity for Mars to learn from a different kind of company in a similar yet still different market. After doing a little bit more research about Kellanova, I found that its strengths are knowing how to develop the global reach of their products, responding to changing consumer habits, especially in convenience, on-the-go packaging, and flavor innovation. If Mars uses this acquisition not just to absorb another brand, but to rethink how it approaches product development and customer engagement, that could be the most valuable outcome of this M&A.

The real long-term impact through this deal might be in how Mars reshapes its internal mindset. M&A is more than just becoming bigger and trying to dominate markets. It is starting to become a way for companies to update themselves, absorb new ways of thinking, and stay competitive in a constantly shifting market.

The Ultimate Guide to Buying a Snack:

When I was much younger, I always looked forward to my parents picking me up from school. I would beg my parents to take me to the deli at the corner of the street.

As I made my way to the store, I asked myself: What was I truly craving? Something salty? Savory? Or maybe sweet? This is similar to the objectives part of the M&A framework presented by Dr. Feldman. The success of a deal is dependent on “identifying areas where the two companies can create value together that they couldn’t achieve separately.” Why do the acquisitions? Better revenues? Market expansion? Global opportunities? Companies evaluate acquisitions based on where value is maximized, on what works better together than alone, just like I weighed whether a savory bag of potato chips or a sweet pack of gummies would satisfy my craving.

Having made my decision of picking gummies, I had to make another tough choice. Haribo twin snakes? Haribo sour spaghetti? Juicy drop gummies? I turned to my parents. They shrugged, indicating that it’s my choice. This correlates to the due diligence aspect during M&A. Just as I considered what I liked about each gummy, companies consider the target company’s strengths; just as I considered which flavor to choose, companies consider how they will integrate the acquisition; and just as I considered which bag had the most gummies and would last me the longest, companies consider which target company will generate the most in the long run. In making my decision, I was evaluating what I was getting before committing to one certain candy. This same approach is reflected in companies assessing their target companies. This time, after a solid amount of time staring between the 3 gummies, I decided I wanted the Haribo twin snakes.

The decision-making was done; now it came down to the cost. The younger me didn’t have the same concept of money that I have now. All I knew was that if the candy cost 2 digits, I wasn’t going to bring it home that night. After selecting the candy, I would grab a bag and show it to my parents. They were either going to look at the price and tell me, “No, this candy isn’t worth it” or “OK, let’s go”. I waited patiently for the “OK, lets go”, because I knew I had behaved extra well that day. “OK, let’s go”. This moment reflected the value proposition during M&A. My parents looked at the price to think about whether the candy was actually worth it, but more importantly what the candy meant to me. Looking back, I recall that my parents rarely refuse to purchase the candy or snacks I wanted. Like my parents, companies would need to assess the target company’s growth potential, consumer base, and competitors during M&A.

As soon as I got home, I opened the bag and pulled a gummy out. The amazing thing about the Haribo twin snakes is that there’s 2 stuck together, with one being sweet and the other being sour. I would always take a bite of the sour snake’s head, and then a bite of the sweet one. It was a perfect blend, just like how companies have to navigate and combine different cultures after an acquisition, to create a plan that works seamlessly. Similar to how Unilever had to navigate Ben & Jerry’s culture, value, and processes, I navigated how to get the most out of my sweet treat. At the time I had no idea that this, too, is a business instinct.

In the end, I want to thank Dr. Feldman for sharing the “Framework of Four.” I plan to continue applying this framework in my daily life and, potentially, in my future career. I can already imagine myself back at the same old deli, standing in the candy aisle, weighing different gummies and mentally running through all four steps; this time, I will also be thinking about how this relates to my future career. Who knows, maybe I’ll stop by tomorrow!