The Conversation: Investing with a Gender Lens

More than ever, investors are using their money to improve the lives of women and girls across the globe. They are supporting companies, funds and types of investments that focus on women, with the goal of championing women business leaders, as well as products and services directed at women. This, in a nutshell, is gender lens investing.

Teen entrepreneur Mikaila Ulmer, featured here in Knowledge@Wharton High School, could well be an example of gender lens investing. The 15-year-old founder of Me & the Bees Lemonade, a successful private company that makes and sells bottled lemonade and donates a percentage of the profits to save the honey bees, received a $60,000 investment from Shark Tank star entrepreneur Daymond John and an $810,000 infusion of capital in 2017 from a group of NFL football players and businessmen. It’s likely that Mikaila’s role as a strong young woman entrepreneur influenced these investors’ decisions.

Eye on the Investor

In financial services, investing with a gender lens typically means buying shares in a mutual fund or other fund that picks stocks (shares of ownership in a public company ) with the goal of advancing the interests of women, while also making investment returns. Funds are pools of outside investments that are managed by professional fund managers who decide how to invest the money. “There’s a lot of interest in gender-lens investing, and it’s more than just a trend,” said Seema Hingorani, managing director at Morgan Stanley Investment Management in New York City. “Lots of capital is going in this direction, billions and billions of dollars.”

Hingorani spoke to high school students participating in the 2020-2021 Wharton Global High School Investment Competition as part of our Meet the Experts series. While she champions investing directly in women entrepreneurs and businesses, Hingorani also wants to see more women on the other side of gender-lens investing – among the professionals who make the investment decisions.

She – and many others – are convinced that gender-diverse investment teams get better outcomes.

“One of the reasons I joined Morgan Stanley was to build my fund, which invests in women fund managers [who manage how money is invested in specific funds],” noted Hingorani, who also started the nonprofit Girls Who Invest. “A lot of men manage money in our industry and they don’t have the same viewpoint that women do. If you’re going to invest in a woman-owned business or a business that focuses on creating products and services for women and girls, and you have no women on your investment team, do you think you’re going to make great investment decisions? When you have a woman on your investment team, you can evaluate that business for its true potential.”

“How are you going to perform well and serve your customers well when you only see a certain part of the world?” — Seema Hingorani, Managing Director, Morgan Stanley Investment Management

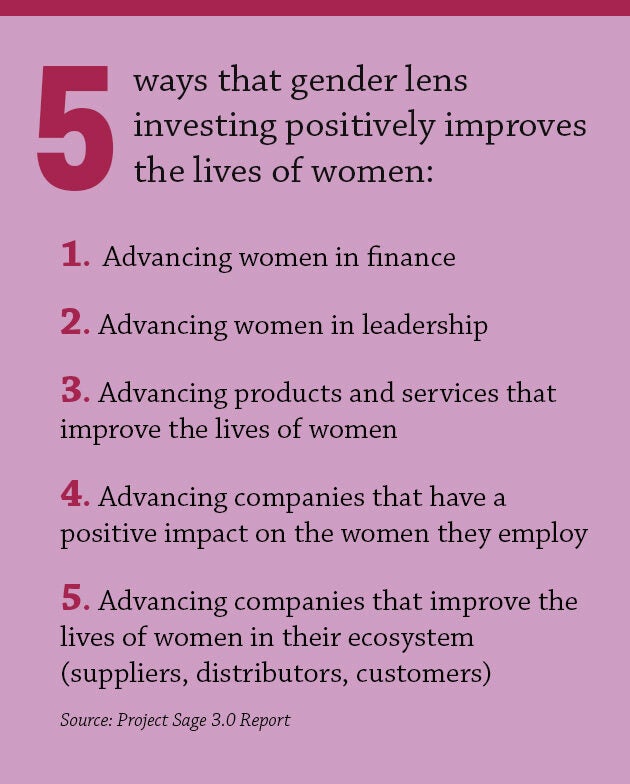

Asset managers like Hingorani who are building gender lens investing networks are watching this growing market closely. Here’s some of the latest research:

Hingorani is dedicated to making progress in this area. “Your customer base is so diverse. Your supply chain is so diverse. If you have people making investment or business decisions who are themselves not diverse, how are you going to perform well and serve your customers well when you only see a certain part of the world?”

Why is Seema Hingorani convinced that diverse investment teams get better outcomes?

More investors are using capital to get an impact return. What does this mean, and can you think of other examples of impact investing beyond gender-lens investing? Visit the Related KWHS Stories tab to explore the concepts.

As an investor, would you invest your money to empower women? Why or why not? If you have done gender-lens investing, tell us your story in the comment section of this article.

I would invest in women blindfolded.

I grew up in a family that never set me limits regarding the business environment, so now that I’m fully aware of the gender issues faced there it stunts me how big is the global issue.

The reason why I would invest in women is because they usually have a higher emotional intelligence quotient than men, giving them clear advantage in the business world since now a days everyone is worried abut the so called “soft skills” –an attribute ingrained in their motherly nature. In the book “Nice girls still don’t get the corner office” Phd Lois P Frankel talks about the reasons why a lot women still haven’t achieve high positions in organizations and remarks how one of these is because their environment hasn’t told them they are capable of achieving that.

If more women start investing in their own gender that will be a statement of empowerment, not only for the benefited parties, but for the future generations to come.

Hi Paulina,

Your family should meet my family. Like you, my family has always spoken about working hard to chase down one’s dreams. They have never separated “him” from “her” or even hinted about a gender issue when considering one’s goals. I know that as long as I put in the time and effort, I have a good chance at becoming successful. However, as this gender lens article notes, we need more gender diversity in corporate America, especially in managerial or supervisor positions. Hingorani makes a great point about how investment decisions can be improved if a woman is behind that lens. Those who wish to invest in women-owned businesses or women-related products and services need to push for gender fairness in their boardrooms. I haven’t read Frankel’s book yet, but I would definitely agree that despite all the recent diversity gains we’ve seen in the past few years, there are still many environments where women are not seen in higher level positions.

One of my recent speech and debate pieces was about women in education, especially in the sciences. I discovered that women who love science encounter social and institutionalized barriers at an early age. Professor Carli from Wellesley College believes the underrepresentation of women correlates to the perception that they are innately inferior to men. This prejudgment carries over to university faculty reviews and human resources promotion opportunities. Per a 2020 California Institute of Technology review, only about 20 to 30% of women are awarded PhD degrees in the physical sciences. A more recent report from the Congressional Joint Economic Committee shows that women make up only 17 percent of specialists in engineering.

But instead of just complaining, I totally agree with you that as women, we have to start believing in ourselves. In the business world, we have to invest in ourselves by learning how to convince venture capitalists to trust and value our ideas or startups. And in order to transform the STEM workforce environment, we need to visualize ourselves as pharmaceutical advisory leaders, medical chiefs of staff, and Silicon Valley CEOs. We need to transcend stereotypes and fight the status quo.

“The changes in economic foundation will lead sooner or later to the transformation of the whole immense superstructure” – Karl Marx.

Technologies, resources, and labor determine the social and economic life of people in our society. In the long river of history, women had always been isolated from the control of money and power. Yet, when women and girls started working in factories during the First and Second World Wars, we met our own sense of self, our own values, and our first feelings of freedom. Once individuals can earn income and build wealth, this automatically provides them with perceived status in our society. Today, female entrepreneurs, as well as companies that improve the lives of women, continue to advance humanity as a whole and break the shackles that have held us back. At last, our world is welcoming an age of women entrepreneurs, like teen CEO Mikaila Ulmer, who is featured in this article.

I was thrilled to read about the growing movement of gender lens investing, where investors intentionally support businesses and funds that advance the lives of women and girls. As mentioned in the article, in 2019, 138 Wall Street Investors raised $4.8 billion 2019 for specific funds that invest in gender-diverse teams and generate a positive impact on women; a dramatic growth of 59% from the previous year. Mikaila, as founder of Me & Bee Lemonade, earned $60,000 investment from Daymond John and an $810,000 infusion of capital from a group of NFL football players and businessmen. She has the power to influence the investors and the world around her. Through this peek at the data, I see an entry point and a chance for advancement of women’s rights and voices.

Since the origin of civilizations, the Earth has always been revolving around the domination of patriarchy, every bit as much as revolving around the Sun. Women and girls have been almost forgotten in history, while the struggles they faced centuries ago continue to surround women’s lives today. However, throughout history, we have chosen not to remain silent. We have woken up and started to acknowledge our own values and the unfairness that has been dismissed as “how things have always been”. We are standing before the door opening toward a world of underrepresented values and voices.

Disempowerment is a second-sex situation, and women as a whole live in it. Living in this world as a young 14-year-old girl, I am surrounded by gender-based marketing, bias, and discrimination. Pink tax is one form that exists daily in my life, and I believe exists in the daily routine of all girls and women. Everyday products for women are almost always more expensive than identical products for men, simply because they are more feminine. Has anybody wondered why clothes for girls and women have either no pockets or really small pockets that are only useful for decoration? Compared to some jackets for men, whose pockets can fit gigantic water bottles? Starting in the 1600s, people began to sew pockets on clothing for more convenient carrying of coins and valuables, but this was primarily for men, while women did not have much economic freedom. Back to more modern days…; By now, I think all women have adapted to the skill of holding a bazillion objects in their hands at the same time! We can see from a small aspect that the act of society favoring men exists in every part of our lives. Really ironic, our wages are lower, but the cost of living for us is higher.

Speaking from the lens of reality: though, 4,093,903,832 women and girls around the world count for about half of the human species. For women aged 11-50, menstrual pads are a basic and essential purchase every month. During 2020 and 2022, lab analysis shows data that 48% of sanitary pads tested were found to contain PFAS (polyfluoroalkyl substances), as were 22% of tampons and 65% of period underwear, (Kluger, PFAS ‘Forever Chemicals’ Are Turning Up in Menstrual Products). PFAs are ubiquitous these days, but these substances directly lead to “high blood pressure in pregnant people, increased risk of certain cancers, hormonal disruption, high cholesterol, reduced effectiveness of the immune system—leading to decreased efficacy of vaccines” (Kluger, PFAS ‘Forever Chemicals’ Are Turning Up in Menstrual Products). It’s hard to accept that I live in a world where my own safety and health as a woman still need to be a concern. “Period poverty” is also not a strange word to us. Despite all the toxic, cheap quality, and unsafe factors, pads happen to be expensive. In 2025, 19 states charge tax on menstrual products, whereas in most circumstances groceries and medicine are exempted from taxes, marked as essential items. Pads still aren’t considered essential items.

Why do we need female entrepreneurs? It’s not a guarantee that life will get better, but with the female investors, entrepreneurs, and companies that fund the advancement of the lives of females, there is hope for our struggles to be solved. They understand our situations, our struggles, and our ambition.