When It Comes to Money, Innovation Abounds

The future of finance is tech-driven and revolutionary, transforming everything from how you manage your money – like mobile payments you make to your friends and e-loans you take out to pay for big purchases – to how entire industries operate.

Take, for example, BioPhy, a health care fintech company just founded by three Wharton School MBAs. The mission of this startup is to fight cancer with finance, by using an algorithm to identify the most promising clinical-drug candidates for cancer, then redirecting capital to those therapeutics to speed up their research, development and, ultimately, approval and adoption. Steve Truong, cofounder, president and CFO of BioPhy, recently told Wharton: “By marrying technology that predicts the outcomes of clinical trials with our disciplined investment process, we have built an AI-enhanced biotechnology asset manager designed to fundamentally change how biotechnology investing is done.”

Introducing the Genesis Cohort

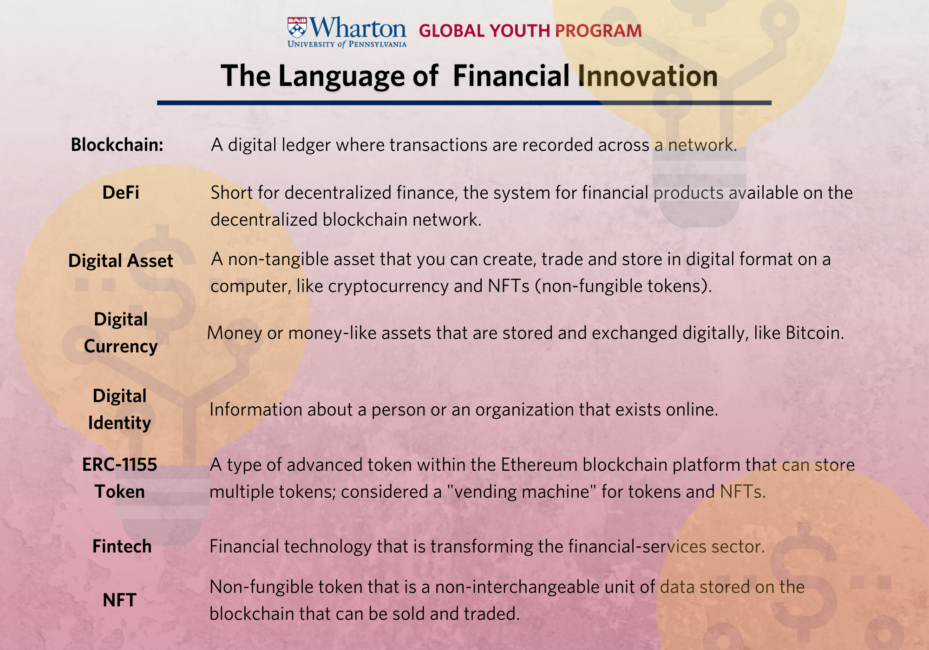

What else is new on the financial-innovation front? We grabbed our virtual wallets and took a spin around Wharton’s campus to discover more about the future of finance (the sidebar at the end of the story explains the language of financial innovation). Here’s what we found:

Wharton’s Stevens Center for Innovation in Finance is brimming with blockchain and cryptocurrency. In recent weeks, the Center’s Cypher Accelerator, an organization that supports start-up businesses focused on decentralized finance (so named because transactions happen without a central authority like a bank) launched its first cohort of companies.

The so-called Genesis Cohort includes 10 startups operating in various industries, such as artificial intelligence, digital identity, insurance, gaming and NFTs or non-fungible tokens. During the three-month program, Cypher helps these companies develop their products, nurture key relationships, build their market strategies, showcase their brands and prepare to pitch to investors.

Among Cypher’s inaugural class: VO2, a platform that builds fan-athlete communities. The platform, which started as a passion project for Wharton sophomore Arham Habib, uses a technology known as athlete tokens, branded and customizable ERC-1155 tokens that act as tickets into exclusive athlete communities. Wharton Global Youth will be speaking with some of the founders in Cypher’s first cohort to learn more about the latest and coolest tech-driven financial innovations.

“Government often encourages and facilitates innovation because it creates those guardrails for trust.” – Kevin Werbach, Wharton School Professor

The flip side of the innovative crypto coin is regulation. The global market for cryptocurrency and digital assets tops $3 million – and growing (Cypher!). And yet, it’s a bit like a virtual wild, wild west as laws and guidelines catch up with innovation.

Kevin Werbach, Wharton legal studies and business ethics professor, stopped by Wharton Business Daily on SiriusXM to discuss U.S. president Joe Biden’s executive order to develop a national policy on cryptocurrency. Werbach leads the Wharton Blockchain and Digital Asset Project. President Biden’s executive order issued in early March 2022 calls for government agencies to coordinate on six key priorities: protecting consumers and investors, preserving financial stability, mitigating risks from illegal digital assets, promoting American competitiveness, ensuring financial inclusion, and guiding responsible innovation.

During his radio visit, Werbach said that he feels digital currency is the “future of the financial system,” and therefore he welcomes more U.S. government regulation. And while the global nature of digital finance presents a challenge for how to impose national laws on an international system, it’s not unsolvable (the internet posed similar issues). “Government doesn’t necessarily stop innovation,” said Werbach. “Government often encourages and facilitates innovation because it creates those guardrails for trust for people to adopt these things.”

Digital Assets, Digital Worlds

Let’s round out our financial-innovation tour by visiting an entirely new realm: the metaverse. This user experience merges virtual reality, extended reality, augmented reality and mixed reality. Sarah Hammer, managing director of the Stevens Center for Innovation in Finance, describes the metaverse as “a unified and interoperable virtual space where users can interact with each other and the 3D digital environment through technology.” Rather than a flat-screen, two-dimensional experience, the metaverse is three-dimensional and multisensory, and therefore more immersive.

What’s the connection to finance? Think back to decentralized finance and all that innovation coming out of the Cypher Accelerator. While the metaverse does not have to be built on blockchain technology, the two digital worlds may well intersect through innovation.

Hammer recently told Penn Today: “The functions and transactions conducted in the metaverse require a high level of security and speed that may be best achieved through blockchain. A metaverse can incorporate blockchain in its technology and crypto assets, for example by using non-fungible tokens (NFTs) to authenticate proof of ownership of digital assets in both the virtual world and the physical world.” Some video games, for example, already allow users to port digital assets between games. User-generated NFTs can be purchased and incorporated into a digital world.

Stay tuned for more financial-innovation intel emerging from the Cypher NFT Incubator supporting global non-fungible token projects, as digital assets lead us into the future of finance.

Conversation Starters

What are three examples of financial innovation from the article. How are they changing the way we interact with money?

Wharton’s Kevin Werbach says, “Government often encourages and facilitates innovation because it creates those guardrails for trust.” What does he mean by this? Is government regulation also thought to stifle innovation? How so?

How are you engaging with financial innovation in your life? What do you see for the future of finance? Share your story in the comment section of this article.

Artificial intelligence, blockchain innovations, and computer simulations are reshaping the financial world–a topic explored in this article. This means that possibilities for increased efficiency, automation, and innovation throughout various financial sectors are highly probable. For example, the article mentions BioPhy which demonstrates how technological advancement opens up avenues for investment in potential fields like biotechnology and healthcare. From this, it can be understood that finance intersects with technology to open up promising investment opportunities in a wide variety of emerging fields.

Among the growing popularity of decentralized finance and blockchain innovation is an increase in funding directed towards startups engaged in digital identity management, insurance, and NFT sectors. This trend is evidence of a possible shift in how both financial transactions and services operate. Despite this development offering various advantages, such as secure peer-to-peer dealings that promote transparency, there are also some challenges relating to its disruption of traditional financial institutions.

As noted in the article, regulating these innovations is crucial to highlighting their relevance. To promote innovation, it is equally important to maintain customer protection and enhance financial stability. A solid groundwork for the innovation mentioned earlier would facilitate this.

I’m a great fan of cryptocurrency, blockchain, and Web3 in general. Ever since I discovered it 2 years ago, I’ve been digging deeper. After studying more finance, I can see how it is crucial for our future. It has the potential to solve many problems people face around the world — for instance, unstable currencies in countries in Africa and South America, or too much reliance on local banks and governments. It’s the first and only thing that allows you to have digital property that cannot be stolen or pirated. No one has ever been able to break Bitcoin’s security.

I agree with you that there should be a clear legal framework to make it more appealing to more people and allow for mass adoption. However, we shouldn’t forget that the foundation of Bitcoin’s creation by Satoshi Nakamoto was to reduce dependence on traditional financial institutions. After the 2008 crash, people were disappointed in the system and needed something that would let them take custody of their money.

BioPhy is just one example of how fintech innovations can lead to breakthroughs in fields where we thought nothing more could be improved. I’d say that cryptocurrency is capitalism in its purest form, and the sky is the limit for innovation. It’s an emerging field, and we’ll see many new companies in the coming years that will improve people’s lives through DeFi. I’m definitely planning to be part of this fintech revolution.