Encouraging New Investors to Uncover the Truth

This summer Wharton Global Youth Program decided to invite students in our on-campus and online programs to share their memorable moments with us. We will be publishing their first-person essays in our business journal and newsroom throughout the year.

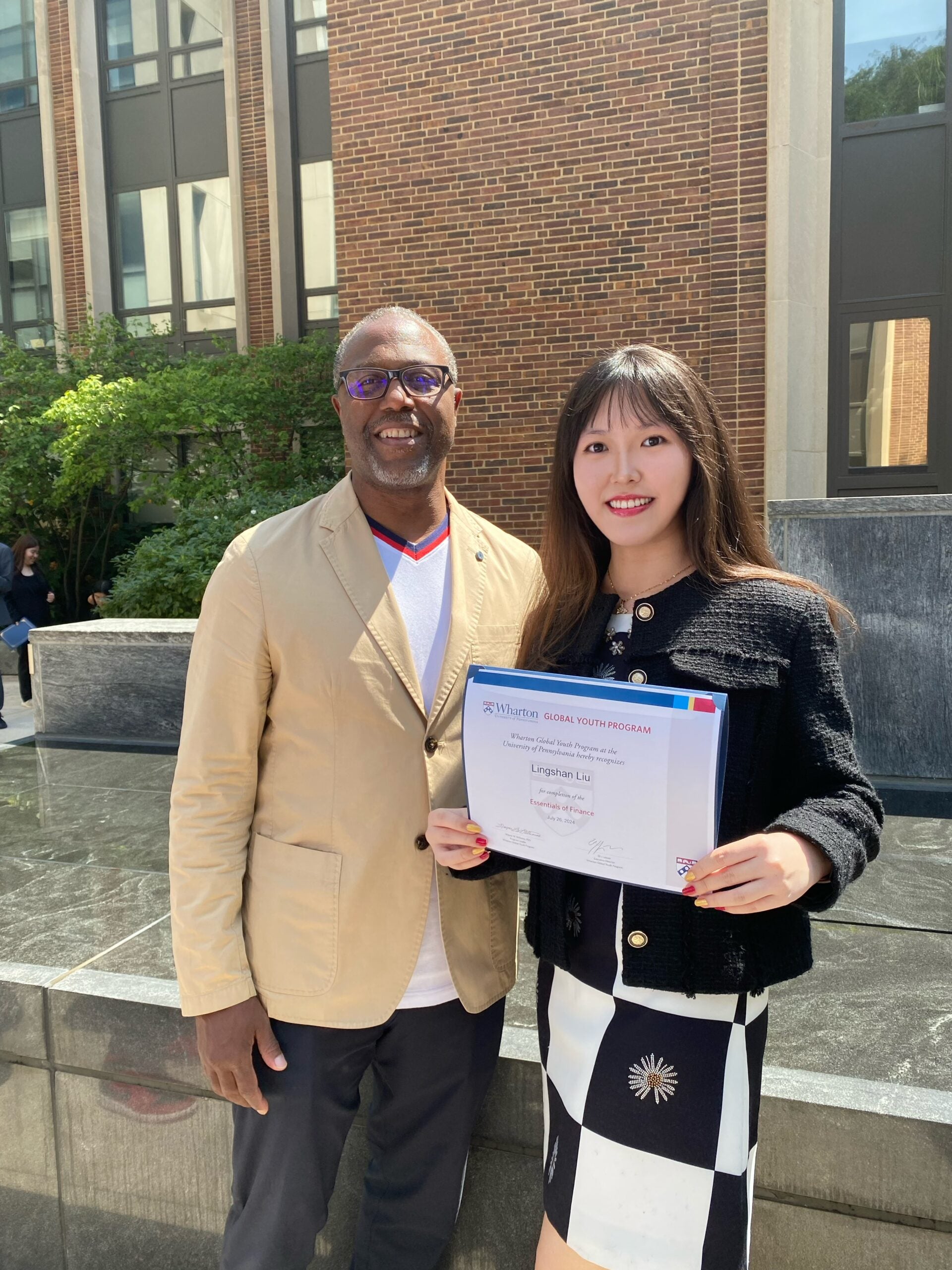

This, our first published student essay from summer 2024, is written by Lingshan L., a true ‘Wharton Global Youth’ who last year served as a team leader in the Wharton Global High School Investment Competition, inspiring her to attend Essentials of Finance on the Wharton School’s Philadelphia campus this summer. Lingshan, who is 16 and founder of the investment club at Jumeirah English Speaking School in Dubai, UAE, was also a strong voice in Wharton Global Youth’s latest Comment and Win competition from June through August.

All these experiences culminated in this first-person essay, in which she shares insights for young investors from her summer studying finance – an appropriate theme as teachers and student teams register for the 2024-2025 Wharton investment competition by September 13. While Essentials of Finance covers a broad range of concepts, her focus on investing principles is a nod to her investment competition peers, past and present. Says Lingshan: “I want to use the knowledge I’ve learned at Wharton to help and inspire more people in finance.”

Have you ever thought about the truthfulness of the 74 gigabytes of data that is processed by your brain each day? In a world where information is disseminated at an unprecedented speed, the distinction between truth and falsehood becomes increasingly blurred. From social media to financial news reports, the content we consume can be filtered, curated, or even manipulated, calling into question its reliability. Nowadays, are we truly seeing and hearing reality, or are we absorbing a narrative designed to influence our beliefs and actions?

In July 2024, I met Dr. Wayne Williams, the program leader of Wharton Global Youth’s Essentials of Finance. During my two weeks learning finance, we discussed the complexities and opacity that often exist in modern society and, more importantly, inside businesses. He emphasized how understanding these dynamics is crucial for making informed decisions in a landscape where data can be both a tool for insight and a mechanism for confusion.

“What you see might not be real – social media or even the news. As an investor you need to have your own thoughts, knowledge and a keen insight to determine the true layer hiding beneath things — what’s real and fake,” said Professor Williams.

With this in mind, my Essentials of Finance project team of five students decided to consider information and data from several reliable websites to prevent biases and misleading information. As our final project, we researched Exxon Mobil Corp. and gave some advice to investors about the company’s operations.

I learned a lot about how to evaluate a business and the power of teamwork during my two weeks at Wharton. Here are some key takeaways:

💸 Teamwork. Valuing a business and working as an advisor is never a job that can be done by one person only. No one can be excellent at everything they do. We learned, discussed, and worked closely together to split the task between the five of us. This allowed us to pool our diverse expertise and perspectives, leading to a more thorough analysis. Moreover, it fosters an environment of sharing knowledge, where we learn from each other and build on those strengths.

💸 Research. Professor Williams stressed the importance of frequent and constant research as an investor. The world of finance is constantly changing every second, which can be influenced by various factors such as economic trends, geopolitical events, and shifts in consumer behaviors. “Only if you do research, you’ll have a wise insight into the business and its market, enabling a more proactive and adaptive investment strategy,” said Professor Williams.

💸 The Business. “You don’t invest in a stock, you invest in the business,” he stressed. It’s essential to understand how a business operates and where its profit comes from. “Costco doesn’t make their revenue from selling goods, they rely on selling their memberships,” he gave as an example.

💸 The Bottom Line. Accounting, considered the language of business, is the key fundamental for making an investment. Understanding what a company’s ‘big’ numbers represent is crucial. The bottom line, the final total on a balance sheet, isn’t just a number on a spreadsheet; it’s the pulse of a company’s true vitality. “Accounting is working with the past, while finance is looking at the future; both are indispensable,” Dr. Williams said.

💸 Models, Markets and More. Making an investment is never a one-step process. It requires a collection of accurate data, information, and your own analysis from a range of sources. “Understanding a company’s business model and its current position in the business cycle is the first step you should consider,” he said. My team and I further developed our dividend discount model (DDM) and discounted cash flow (DCF), valuation methods we compared with the market value to better understand the value of the business and help us make a more informed investment decision.

During my two weeks at Wharton, I considered myself an investor. I learned about all the detailed and complex valuation processes needed to make informed investments – and I grew to appreciate finding truth through careful and multi-layered research. I now have a significantly better understanding of the financial world, and I’m inspired to explore this field more deeply!

Investing is one of those rare activities where the numbers matter immensely, yet relying too largely on them is a surefire way to miss the mark. You can scrutinize financial statements, track market trends, and build valuation models so AI can invest for you, but at the end of the day, investing is part data-driven logic AND part intuition.

The weirdest part about investing is that it requires a willingness to think beyond the spreadsheet, beyond historical trends, beyond the cold, hard facts that everyone else sees. It’s about understanding human nature. The psychology of markets, the narratives people buy into, the illusions that shape attitudes that, in turn, shape actions. It’s less about endlessly calculating probabilities and more like predicting how a movie, series, or story will develop, anticipating plot twists based on patterns, narratives, and perspectives you’ve seen before that shape your unique intuition and perception of situations.

I totally agree with your key takeaways. Investing is what got me excited about finance and economics. I’ve been doing it for three years now, and I’ve learned a lot of what you mentioned. Beating the market is hard, and all the data can feel like too much sometimes. Like Professor Williams said, first you need to figure out what’s true and helpful and what’s not. Then it’s about doing good research and keeping it up to date. I really like the idea—I think Warren Buffett said it—that you’re not just buying a stock, you’re investing in a business. That’s super important to me.

I also think teamwork doesn’t get enough credit. I got my friend to start investing, and it’s helped us both a lot. Sometimes he sees things I miss, sometimes I catch stuff he doesn’t, but together we make smarter choices and do better. Nobody’s perfect, and with so much data out there, it’s easy to mess up if you’re on your own.

Investing is tough, for sure, but if you take it step by step and put in the work to research—even when it’s boring—you’ll set yourself up to succeed in the end.

Reading this specific essay brought me back to the first time I invested.

When I was 12 years old, I looked at a brokerage account online for the first time. I was fascinated by the green candles and the swiftly moving numbers. Granted, it was under my dad’s name, but I was excited to step into this new “grown-up” world. I was always infatuated with trading, despite not knowing the difference between account types, stocks, or crypto. The first move I made—or the first investments I forced my dad to make—were a cryptocurrency named Dogecoin and a stock for the company GameStop. I picked these two because I found it funny that a meme was a form of currency, and GameStop because I liked video games. I had heard about them very briefly in the news, but I had no clue what was driving their surge. This time, I had lucked out, with Elon Musk’s tweets supporting Dogecoin, and Roaring Kitty with his push for Gamestop; we made a pretty substantial amount of money. I had no idea about the millions of people who were on Reddit spaces, YouTube comments, urging each other, and “YOLOing” their money into these “meme” stocks and crypto. I also had no idea there was a movement behind it all—some kind of protest against corporate greed (still not sure what that was about). But at the time, I thought to myself, “Wow, I am an amazing investor. I could retire my family just off this!” I finally convinced my parents to open a youth account for me. But as the saying goes, what goes up must come down; my investments crashed. I put stocks and crypto to the side for three years and moved on to the next big wave: NFTs.

NFTs are a story for another time–In short, I tried making my own and failed spectacularly. But having recently turned 16, I am wiser in terms of investing (or so I’d like to think). Lingshan’s essay resonated with me strongly. The lessons she learned during the Essentials of Finance program—especially the difference between investing in a stock and understanding the business—highlighted what I had been missing at the time.

Looking back, the biggest thing I lacked was research. The real reason people were buying these types of meme stocks and cryptocurrencies is not because of what the companies are doing, but rather because of the hype and buzz generated by social media. Investors ride the excitement, which causes huge price swings. Nowadays, I am more interested in ETFs, such as the S&P 500, which includes the top 500 companies. This is a much smarter choice of investment, as these companies are steady and reliable. Even individual companies like Apple or Amazon would’ve been smarter investments. Sure, at that time I made money, but if I hadn’t sold the specific day I did, my family and I would’ve lost thousands of dollars.

But what I most appreciated about the essay wasn’t the technical insights; rather, it was the emphasis on truth-seeking. As much as I care about financial outcomes, I’ve realized that understanding and clarity matter more. In today’s world, it seems as if everyone has a different opinion. In an internet full of YouTube course sellers, TikTok finance bros, and Reddit YOLOers, I feel like the only judgment I can trust is mine. Maybe it is because I scroll too much online, and all these conflicting points of view I have absorbed are fighting against each other. Invest in Apple! Invest in Google! Every day is a mental tug-of-war, and this goes beyond investing, too. No matter what you do, someone has an opinion on how you are doing it wrong; telling you the way you brush your teeth is not optimal, the way you shoot a jump shot is too clunky, and even the way you write is too fast. Finding clarity has become more important than ever, and this essay proved to me that it starts with one simple step: doing your research.

I love how Lingshan emphasizes that “you don’t invest in a stock, you invest in the business.” That insight resonated with me–it reminds me of Charlie Munger’s point that practical, everyday experiences, like a mundane grocery shopping trip, can reveal investment indicators and opportunities. Munger often mentions how he’s spotted bargains in grocery aisles long before Wall Street noticed. That kind of observational investing, rooted in curiosity and grounded in real-world context, brings a fresh angle to Lingshan’s emphasis on research.

Additionally, I think the point on teamwork was a real gem; while people obviously do retain the ability to invest on their own, teamwork really does make the ‘portfolio’ work. It’s impossible to eliminate biases and think of the most creative solutions without people around you offering different perspectives and having your back.

Reading about the Exxon Mobil analysis and the emphasis on triangulating data, I found myself asking: what overlooked clues am I ignoring in my own life that hint at bigger trends? It shifts research from being a distant, spreadsheet-based task to something that grows from paying attention to the world you interact with daily. In that sense, Lingshan’s piece isn’t just about financial tools or methods—it’s an invitation to train your observational instincts, a skill that serves both trading and lifelong learning.

“Have you ever thought about the truthfulness of the 74 gigabytes of data that is processed by your brain each day?” I never knew that it was 74 gigabytes. That’s a lot! But that raises a question: Have our brains evolved like computers? And if so, how does that translate to language learning?

Let me answer with a question: Computers have evolved tremendously in the last 20 years. They’ve gotten more efficient, fast, and overall more capable. Our brains, however, have not had the biological time to evolve at the same rate computers have physically. Perhaps our thoughts and ideas have become more efficient, but what if we’re becoming overstimulated? We aren’t processing or filtering information well. We can take in more, but can we make sense of more?

Are we becoming addicted to uncovering truths, leading to a positive feedback loop where technology evolves, and we want to do more with it? To answer this question shortly, yes. Think about AI and how much it changed the world. People are hungry to uncover what they can do with AI. However, we may be mistaken in confusing volume for clarity or access to wisdom. That’s dangerous. Could this lead to a catastrophic situation where we compromise our processing and filtering systems due to excessive overstimulation? If we overload our ability to filter, we lose our grip on what matters, what’s real. You end up with truth inflation when everything is labeled “important,” and nothing truly feels it.

Or will we take knowledge for granted, as we already do, simplifying it instead of taking it for what it is? To some extent–yes. I don’t know how a computer works, and I couldn’t go back 1000 years and explain to someone the science behind its function, so I take it for granted.

Pivoting to language, are we downloading language in gigabytes too? Or are we translating it into meaning in a deeper, more analog way? I think we do download languages in gigabytes; however, my personal experience with it is that our brains have different “brains” for each language. Each language you speak conveys different behaviors and emotions. When we learn a new language, we’re expressing ourselves in ways that our brains already want to express themselves in but can’t in existing languages that limit our expressions, such as English or other languages. For example, you can sound “romantic” or at least try to in English, but romance languages, like French, make it almost natural, as if you don’t have to try, allowing you to push your limits.

On the other hand, Mandarin, with its complex words and hyper-specific meanings, can truly convey precisely what you’re feeling, unlike other simplified languages like English. That allows you to push the limits of how you want to express yourself. It’s almost like language gives shape to different “selves” you didn’t know existed. And in that way, languages are a way to shape different versions of ourselves that we didn’t know existed. Languages are about activating pre-existing modes of expression that previously had no outlet. That might be the antidote to overstimulation. Not shutting the world out but expanding the number of filters you have. Instead of one lens (your native language, culture, framework), you gain five. And that lets you see what matters more clearly.

Even then, with different lenses, we’re evolving fast. New boatloads of information force us to simplify even further. In data and opinions, we’re prompted to make it all into something digestible: headlines, tags, tweets, and AI summaries. The tools we use to “make sense” of the world are, ironically, flattening it.

If language can help us push past overstimulation and truth inflation, what happens to those who never develop more filters? Do they become numb? Or worse, easy to manipulate? They may become numb and easy to manipulate. So it’s a scary thing.

One night, I was scrolling through Facebook Marketplace looking for a graphics card. I’d been saving up for months to upgrade my PC, hoping to finally play my favorite games without lag. Then I saw it — a top-tier GPU at a price so low it didn’t seem real. The photos were crystal clear, the description sounded perfect, and I was already imagining how much better my games would run. But something bothered me. I reverse image-searched the photos and discovered they were straight from Google. The seller had no proof it was theirs — no box, no receipt, not even a picture of it in their setup.

Reading Lingshan L.’s essay reminded me of that moment. She wrote, “What you see might not be real,” and I saw how that applies to more than just investing. Reading about how she and her team dug into the real story behind Exxon Mobil’s data, I remembered having to look past the surface of that graphics card listing to find the truth. At first, I felt the rush of hope — thinking I had found the perfect deal — but that turned into disappointment when I discovered the photos were fake, and finally relief knowing I’d avoided being scammed. In her case, it was about giving accurate advice to investors; in mine, it was avoiding a costly mistake. But in both, the lesson was the same — question what you’re given and look for proof before deciding.