10 Truths about Smart Financial Decision Making

High school students are passionate about financial education. The demand for our Wharton Global Youth on-campus Essentials of Finance program prompted us to create a new online program for high school students this summer that we are calling Financial Decision Making.

Students’ passion extends to spreading that financial knowledge. Our team often receives pitches from potential Future of the Business World podcast guests about teens’ efforts to improve youth financial skills and fight economic inequality across the globe.

Take, for instance, Isaac H., a high school student from rural Indiana in the U.S. Isaac founded Students Teaching Finance, a student-led nonprofit that teaches personal finance to K-8 kids. We’ve also met Amanda L. B., founder of The Financial Girl, which specializes in teaching teens about personal finance in public schools across Puerto Rico. And we featured Sam P. on our podcast, a high school student from Vancouver, Ontario, Canada who founded MyFLY to build and implement a financial-education curriculum in schools worldwide.

Making Smart Financial Decisions

We could add more names to our podcast pitch list! But instead, let’s pivot to meet a decades-long expert in the financial-education field. Olivia S. Mitchell, a professor of business economics and public policy at the Wharton School of the University of Pennsylvania for the past 30 years, is a leader in financial literacy, which she defines as “the knowledge and the capability to act on financial, economic principles.”

Dr. Mitchell joined Wharton Global Youth’s summer cross-program speaker series to talk about financial literacy to several hundred high school students participating in our on-campus summer programs. “I have been passionate about financial literacy for a long time,” she told them. “I believe it’s critical as members of an educated society to have the tools and the understanding of financial risk management.”

Here are 10 truths about financial decision making that Professor Mitchell shared with Wharton Global Youth students:

1️⃣ Risk management of any kind involves three steps: Identify the risk so you know what you’re facing; mitigate or reduce the risk; and finance or insure the risk. “You’ve got to make sure you are protected by amassing enough money,” noted Dr. Mitchell. “If you become unemployed, you should have six months of savings to draw on. And with insuring, you put some money into a risk pool. Buy insurance against poor health and disability. For example, if you own a home, you [buy insurance] because you want to make sure that if it burns down, you have some compensation.”

2️⃣ People get into financial trouble for many reasons, deepened by the fact that they undersave and/or overspend. They face health shocks like a disability that might leave them without income for many years, or they become unexpectedly unemployed. And more people are living much later in life. All these factors can throw people into financial crisis.

3️⃣ Financial literacy is an important part of risk mitigation. Said Professor Mitchell: “If you are financially literate, you’re going to plan better, budget better, save more, and when the time comes to retire, you’re going to pull out the right amount of money — and not too much” that you then have a shortfall when you get older.

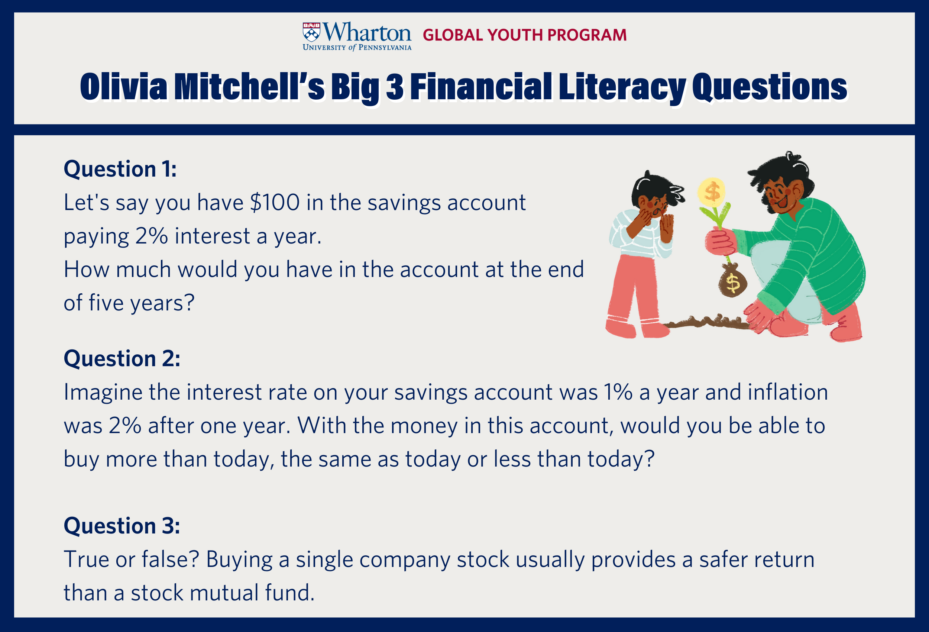

4️⃣ More than 15 years ago, Professor Mitchell and a colleague devised three key questions to determine financial literacy (see box). “There are a lot more [financial] concepts, but if you can’t answer these three questions, you’re in big trouble,” said Dr. Mitchell. (Find the answers in the comment section of this article).

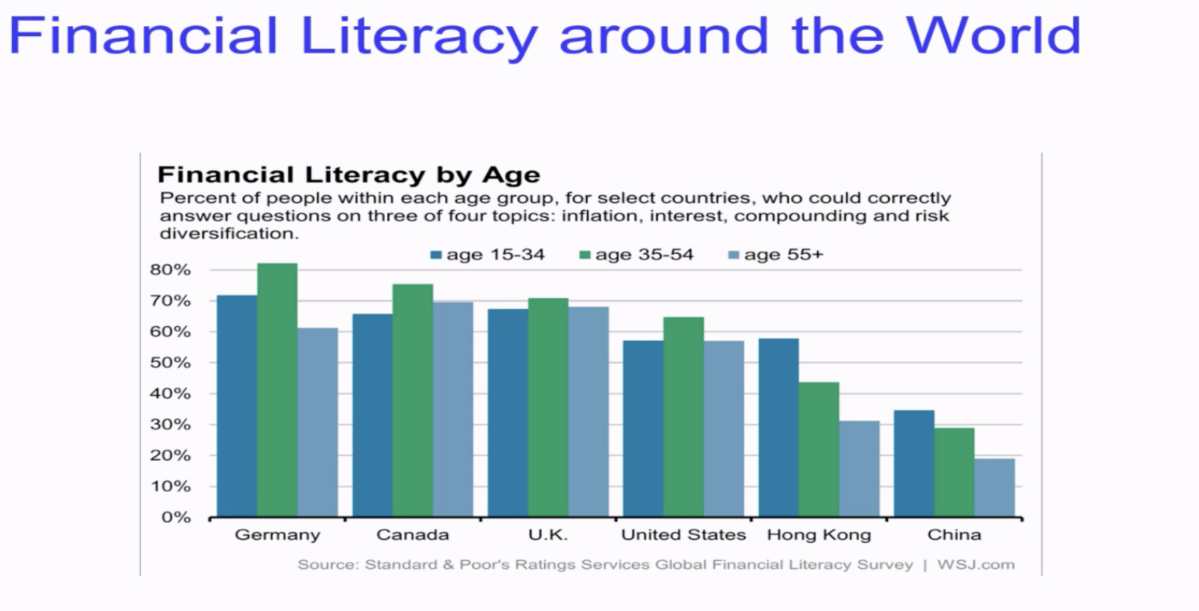

5️⃣ Financial illiteracy is a global challenge – with opportunity for growth in financial education. (see graph). Why is China less financially literate? “There’s a huge rural population in China,” observed Dr. Mitchell. “And even in the urban areas, they still only have nine years of mandatory education and kids just don’t get exposed to financial decision making.”

6️⃣ How long do you need to think about managing your money? Average life expectancy is 77 or 78 years in the U.S. and longer in other countries, like Japan. “There’s been an enormous expansion of our lifetime, which means there are a lot more years for you to make financial mistakes or to apply your financial literacy,” noted Dr. Mitchell. Babies born today will live to 100 or beyond. And demographers say that a baby has already been born who will live to 200. “You should plan for it because if you don’t, what will happen? You’ll run out of money,” cautioned Mitchell.

7️⃣ Understand retirement investment allocations. Whatever you put into [a retirement] plan and decide to save; what you earn on that money while it’s invested; and what you might earn from an employer matching plan is what you will have for retirement later in life. “This is where financial literacy becomes critical,” urged Professor Mitchell. “If you don’t understand the lifespan that you’re going to be saving and investing for, if you don’t understand risk and risk mitigation, and if you don’t understand the danger of outliving your money, you’re going to make all those decisions wrong.”

8️⃣ When it comes to retirement savings, the earlier, the better. When your financial advisor gives you a rule of thumb or your employer says that people on average should save 3% of your income for retirement, don’t believe them, suggested Dr. Mitchell. You should be saving 20% to 25% of your income. “If you assume Social Security will pay you a 50% replacement rate – replace about half of your pre-retirement income – then you will have to come up with the rest of the income stream by saving on your own,” she said. “If you start at 25 for retirement at 65, with an expected rate of return [on your money] of 3%, you will need to save 11.11% of your income. If you waited until you were 20 years from retirement because you had to pay back your student loans…and didn’t have a lot of available income to save, you would have to save more than a quarter of your income for retirement.”

9️⃣ An expected long-term rate of return of 3% is a good scenario. Economists predict that the rate may fall in the future. “Population aging and the decline in fertility means that worker productivity will not increase enough to keep rates of return high. Then maybe what you’re going to get is a 1% long-term rate of return.” That will require you to save even more for retirement.

🔟 Dr. Mitchell predicts that our financial health depends on bolstering family and individual financial literacy; saving more money, working longer and insuring better; reforming banks, pensions and Social Security; and developing new risk-financing tools.

Conversation Starters

Are you passionate about financial education? Share your story in the comment section of this article.

What are your biggest takeaways from Professor Mitchell’s lecture? Has this inspired you to better manage your financial risk?

Why is financial literacy an important part of risk mitigation?

Here are the answers to Dr. Mitchell’s financial literacy questions:

Question 1: Of three choices: less than $102, equal to $102 and greater than $102, the answer is greater than $102.

Question 2: Less than today. “If the inflation rate exceeds the interest rate on your account, you have less purchasing power after a year and much less after two or three years.”

Question 3: False.

Hello, I don’t believe the first question is correct. First of all, it doesn’t specify whether it’s a compound or simple interest rate, so I just assumed it’s compound. Secondly, it asks for how much is in the account at the end of 5 years instead of after 1 year, and there are no answer choices provided. The answer should be 100 * (1.02^5) = $110.41.

thanks for sharing!

Thank you, Diana Drake, for such an enlightening article on the importance of financial literacy and smart financial decision-making. Professor Mitchell’s insights are truly invaluable, especially in today’s rapidly changing economic landscape.

As a high school student passionate about financial education, I was particularly struck by the examples of my peers, like Isaac, Amanda, and Sam, who are making significant strides in improving financial literacy among young people. Their initiatives demonstrate the powerful impact that youth-led efforts can have on promoting financial education and combating economic inequality.

Professor Mitchell’s emphasis on the necessity of risk management and the critical role of financial literacy in ensuring a secure financial future resonated deeply with me. Understanding how to identify, mitigate, and insure against risks is crucial for financial stability. Additionally, the point about the need to save significantly more than the often-recommended percentages for retirement is a crucial takeaway that I believe more young people should be aware of.

The reality that financial illiteracy is a global challenge presents both a concern and an opportunity. It’s clear that we need more robust financial education programs worldwide, especially in regions with limited access to such knowledge.

This article has inspired me to further my efforts in financial education, not only for my benefit but also to help others in my community understand the importance of financial planning and risk management. I’m motivated to share these insights with my peers and work towards a more financially literate generation.

Thank you again for this comprehensive and inspiring piece.

Thanks Diana for this eye-opening piece of work! I truly believe in the importance of financial literacy, and the significance of educating everyone on the topic. Let me give you a bit of my side to this story which truly highlights the importance of financial literacy.

I’m 15 and I’ve been investing for about six months. Very recently, a lucrative financial opportunity appeared to have bloomed out of the markets, with the meme stocks by the likes of Gamestop (GME) and American Movie Classics (AMC) skyrocketing through the roof. My parents had just recently opened a youth account for me to invest in, and I was hooked to it. I would constantly monitor the markets with really no idea on with what I was doing. I deposited my life’s savings, which amounted to a grand total of about five thousand dollars, into the account. I rushed to join the haze of people excited by the volatile movements in the stocks. My impulsive brain thought it would be smart to invest $2500 into a meme stock; this one action, which took about eight seconds and four clicks across a computer board, still haunts me to this day. I had commited to AMC at almost its absolute peak, and within four hours, it had slipped 40% and I had lost money in the four digits. Though it only took me a month to flip the script by the likes of NVDA and FSLR, I had experienced something that felt almost illegal. It could be almost be regarded as gambling, but just with a different name: “investing”.

If I had been the slightest more educated in financial literacy, I would have understood that as an outsider, investing in meme stocks is practically equivalent to roulette. If I had listened to Dr. Mitchell, I would have had the epiphany that compound growth is the key to success, and people seeking to find instant-gratification and instant money-makers are doomed to fail. Investing is all about its long-term outlook, and there are no such things as a shortcut.

In today’s world, school doesn’t teach you anything about financial literacy. They teach you everything except how to manage your money, which is quite depressing as that is one of the most fundamental skills we should all strive to possess. That educating step is what can allow all people, and especially the younger generation, to live a more prosperous life filled with financial security.

Thanks so much for the article, and I hope you enjoyed my story!

I am thrilled to share my thoughts on this insightful article about smart financial decision making. As a high school student, I am extremely passionate about financial education and its significance in shaping our future. My passion for finance has driven me to set ambitious goals, including pursuing a career in investment banking or private equity. I am currently considering obtaining my Chartered Financial Analyst (CFA) designation, but my parents are encouraging me to explore the Certified Public Accountant (CPA) route instead, with the aim of opening my own accounting firm. I hope to make a decision by my first year in university.

Professor Mitchell’s lecture has been an eye-opener, and I have taken away several valuable lessons. Firstly, the importance of risk management and mitigation cannot be overstated. It is crucial to identify, reduce, and finance or insure risks to avoid financial crises. I was particularly struck by the fact that people often undersave and overspend, leading to financial troubles. This has inspired me to prioritize saving and budgeting, even at a young age.

Another key takeaway is the significance of financial literacy in making informed decisions about retirement investments. I was surprised to learn that saving 20% to 25% of one’s income is recommended, rather than the commonly cited 3%. This has made me realize the importance of starting early and being proactive about retirement planning.

Lastly, I firmly believe that financial literacy is a critical component of risk mitigation. It enables individuals to make informed decisions about their financial resources, avoid costly mistakes, and plan for the future. In today’s complex financial landscape, it is essential to possess the knowledge and skills to navigate financial risks and opportunities.

Overall, I am grateful for Professor Mitchell’s insightful lecture and the opportunity to reflect on my own financial goals and aspirations. I look forward to continuing my financial education and making informed decisions to secure my financial future.

Fortunately, I correctly answered all three questions, thanks to a year in the finance program “Rock the Street, Wall Street” (RTSWS) organized by my school’s finance club “Females in Finance!” In it, I learned many financial skills that I didn’t know before, such as how to split up a paycheck into college savings, emergency savings, checking, and entertainment, and other things listed in the 10 truths. Although I always knew the importance of saving, I didn’t realize how complicated it was. I was alarmed that I wasn’t aware of this before, and because of this, I completely agree with Dr. Olivia Mitchell that everyone should start learning financial literacy as early as possible.

In RTSWS, the most important lesson I learned was that it is never too late to learn financial literacy. Any amount of knowledge will greatly improve our attitudes towards saving and spending. Because the next generation is the future of the world, it is necessary to ensure their financial literacy. When adults become more financially aware, they will, in the best-case scenario, teach their children to be so too. However, I was surprised to see how low the US was on the graph compared to Germany, Canada, and the UK. Now that I think about it, there was barely any financial education in my curriculum, save for a few classes in elementary school that I barely remember.

What I was also surprised about is how, despite the overall financial literacy levels for Germany, Canada, the UK, and the US being higher than those of Hong Kong and China, the younger generation of Hong Kong and China are more literate than their older generations, especially in Hong Kong. The score from the age group 15–34 is almost 20% more than the age group 35–54, and is almost 50% more than the age group of 55+. The scores from Hong Kong and China show that their younger generations have significantly improved in financial awareness. In fact, the graph shows a steady increase of literacy from the oldest age group. On the other hand, the financial literacy of 15–34-year-olds in the west is lower than the financial literacy of 35–54-year-olds, showing insufficient education to catch the younger people up to the more financially experienced adults. Although it is true that adults are more experienced than younger people, it is also true that they should be passing their knowledge down to us, which I fail to see happening.

Despite my high school having a (fairly popular) finance program, it is not noticeable enough. We had one email on it, and there were no posters in the hallways. I almost didn’t go to it before my friend, who was encouraged by their parents, persuaded me. I am now relieved that I went because these concepts are too fundamental to not know, and the fact that it is an optional program is far from ideal. Not all of us will become a physicist or historian when we grow up, but we will all earn paychecks, pay taxes, and retire. If we have mandatory CPR and second language classes, then we should also have a mandatory finance class, especially in high school since colleges are notoriously expensive. For schools supposedly preparing us for adulthood, there is a worrying absence of guidance on one of the most basic life skills.

Although those living paycheck-to-paycheck or relying on welfare are unable to save as much as the more fortunate can, I believe part of the solution will be to raise awareness of saving and risk management. Financial literacy is important to prevent financial issues, and education will act as a great starting point. I am fortunate enough to have gone to my school’s program, but talking to my peers or parents, I realize there’s still so much I don’t know yet.

Especially with the rise of AI and easy-to-access information, the younger generation can quickly find financial tips, and technology will greatly help people learn financial literacy and gain awareness of its importance. Isaac, Amanda, and Sam have inspired me to help the youth build their financial knowledge. I plan to make a software to not only teach those who want to learn but also advise them on personalized financial planning. I hope to help the next generation in any way possible, and one is to increase financial education.

Financial literacy plays a crucial role in our lives, influencing everything from everyday budgeting to long-term retirement planning. Professor Mitchell’s insights highlight how being financially literate empowers individuals to navigate risks effectively. One of the key takeaways for me is the necessity of early and robust retirement savings. Mitchell’s advice to save 20-25% of income rather than the conventional 3% recommendation really underscores the importance of starting early and saving consistently. This lecture has definitely inspired me to reevaluate my own financial strategies and ensure I’m better prepared for the future, particularly in understanding investment allocations and adjusting for potential changes in economic conditions. It’s clear that being financially literate isn’t just beneficial—it’s essential for securing a stable financial future amidst global economic uncertainties.

Professor Mitchell’s ten truths on financial decision making helped me understand the basic concepts of financial literacy. I’m participating in the new Financial Decision Making program, and I truly believe that the ability to make informed financial decisions is one of the most important life skills. Managing finances is critical for individuals to be able to live comfortably.

The first truth Professor Mitchell states about financial decision making is risk management, which is perhaps the most important aspect of managing finances. Economies are extremely volatile, and individuals can lose their life’s savings with one black swan event. The pandemic and economic recession is a prime example of an unexpected event that caused financial difficulties for many people. Many companies’ stocks plummeted or went bankrupt. If people had invested solely in a single company that struggled in the pandemic, they could risk losing all their money. To prevent financial disasters, it’s important to store and invest money in multiple reliable sources to mitigate risk.

The eighth financial tip that stresses the importance of saving early for retirement is another fact I find particularly important yet often overlooked. Many people who get their first paycheck don’t think fifty years into the future and save for their retirement. However, time is one important aspect of growing your money. Individuals who start saving and investing earlier will accumulate much more wealth compared to those that start later because of compound interest. According to the chart marking financial literacy levels around the world, younger individuals aged 15-34 are not as informed as older people aged 35-54 in many countries. It’s critical to understand the financial world from a young age to start saving up early and reap the benefits of compound interest through a longer period of time.

Financial knowledge is essential for individuals to manage their money properly to reduce risk, be able to retire, and ultimately live a comfortable life. Young people especially need financial knowledge to save up early and benefit from compound interest. I’m exhilarated to learn about the financial world in Wharton’s Financial Decision Making program, and I hope to inform my peers on the importance of understanding finances so we can boost financial literacy among the younger generation.

I couldn’t agree more with what Professor Mitcher said about the importance of financial literacy. Nowadays many countries, especially developed countries, are experiencing the problem of an aging society with a low birth rate. Acquiring sufficient financial knowledge to manage our accumulated cash in a reasonable and effective way to withstand the risk of inflation, is one of the important guarantees for living a good and comfortable life after retirement. Some people may ignore the importance of financial management or financial literacy because those people don‘t realize that money does not equal wealth. Money is only a current medium of exchange in the form of coins and banknotes. Therefore, the cash in our hands will depreciate over time due to various external factors beyond our individual’s control. Next, I want to share the personal experience of my granduncle, who is my mother’s uncle, to illustrate that money does not equal wealth and that inflation will turn the money in our hands from a huge amount of fortune into much less valuable banknotes over time.

In the early 1980s, my granduncle, Jie, left his hometown, Fuzhou, a city in southeast China, and came to Hong Kong for a much better-paid job. In the early 1980s, the average monthly wage of a worker in mainland China was around 40-50 Chinese Yuan per month. However, my granduncle, Jie, easily found a job with a monthly wage over 1600 Chinese Yuan in Hong Kong at that time. Not long, my smart and hardworking granduncle started a small business in Hong Kong. Fortunately, his business went well and after only 10 years of hard work, my granduncle accumulated his first one million Chinese Yuan. In the early 1990s, one million Chinese Yuan was a huge fortune in China because the average annual household income was less than 3000 Chinese Yuan in his hometown at that time. My granduncle thought if he deposited all his cash in a bank, with an annual interest of 3%-5%, he would receive an annual interest income ranging from 30,000 to 50,000 Chinese Yuan. The interest income alone would allow him and his family to live a very prosperous life in his hometown. Therefore, my granduncle decided to go back to his hometown and retire at the age of 46. In the following 30 years, my granduncle witnessed rapid economic growth not only in his hometown but throughout China. Accordingly, the income of ordinary Chinese people has increased, so have inflation and living expenses. In the first 10 years, although living expenses were increasing, Jie and his wife did live a happy and rich life. However, gradually, especially after 2010, Jie found out he needed to carefully plan his budget to make ends meet. He began to feel that it was becoming increasingly difficult to live on his interest income alone. Unfortunately, Jie’s wife was critically ill in 2012. Jie had to withdraw a portion of his savings to cover his wife’s medical expenses that were not covered by insurance. After his wife was discharged from the hospital, Jie continued to spend a lot of money for the subsequent rehabilitation treatment and a full time nanny to take care of his wife. Before 2020, Jie finally ran out all of his savings. Fortunately, Jie and his wife have 4 daughters and they are all financially successful, each of whom is willing to contribute to part of Jie and his wife’s living expenses. Jie told my grandfather that he felt very regretful that he deposited all his money in a bank. If he invested all of his money in real estate, he could buy at least 10-13 units of apartments in the center of his hometown in the early 1990s. Over the past three decades, housing prices in almost every city of China have skyrocketed. The total value of real properties could increase from 1 million Chinese Yuan 30 years ago to an estimate of 20-30 million Chinese Yuan in the 2020s. The rental income would also ensure him and his wife a stable and comfortable life. Certainly, there are other investment options that could increase my granduncle’s wealth insteading of putting all cash in a bank account.

From my granduncle’s story, we can see the importance of financial literacy, especially when we are making long-term financial goals. It helps us “plan better, budget better” and ensure we will have the right amount of money to live a prosperous and comfortable elderly life after retirement. My granduncle, when making decisions for his retirement plan, overlooked the fact that 1 Chinese Yuan today would have significantly diminished purchasing power in 20 or 30 years. Just as Professor Mitchell said ” Financial literacy is an important part of risk mitigation.” Therefore, if we plan long-term financial goals, it is important to consider the risk of inflation and also to try our best to mitigate possible financial risks.

Like Grant’s experience of investing, I also started investing relatively recently, about one year ago. When I stepped into the stock market world, I realized that money can be earned fast and lost fast through investing. I started investing with a thousand dollars provided by my parents. I first experienced earning money briskly, where I could earn about 10 dollars in mere minutes. Through the process of buying and selling stocks, I was able to earn about 100 dollars in 3 months. Subsequently, however, I experienced failure, losing over 300 dollars in the following four months. Grant’s comparison of investment to ‘gambling’ resonated as a term that identically reflected my past experience of investment, where the only action I took was guessing the flow of money without understanding my stock and the basics of investments.

Besides stock investment, my sense of urgency to learn financial literacy has grown more nowadays as the global economy is experiencing high inflation, people struggle with high bank interest rates, and people intensely negotiate their yearly wage raises.

Recently, I was struck by the following question. What does it mean to live in the era of “inflation?” My simple answer was a decrease in money value. That was all. However, the following two questions by Professor Darrel Duffie at Stanford University that I encountered recently puzzled me even more. Which option would you choose, a seven percent decrease in your wage with zero inflation or a five percent increase with 12 percent inflation? Truth be told, I had no idea what his intention was nor what the question meant. Imagine how madly I would choose the latter, fuming at the employer at the word “decrease.” Little did I know how inflation dropped the value of our money and even the wages people should receive.

To be more specific, I was receiving ten grand. In 10 percent inflation, my wage was reduced to nine grand. So, to answer the question, the former option made my wage 9.7 grand, while the latter option came down to the same 9.7 grand. It showed how indifferent I was to all these financial terms, and it was clear to me I would be easily manipulated during the salary negotiation without a tangible understanding of financial literacy. Living in the post-pandemic high-inflation world, I was “ignorant” about how it affected my life. Many workers out there may feel the same way. The market price soars, but my allowance from my parents stays the same. One disadvantage to learning financial literacy is that now I feel like my parents forcefully reduced my allowance without my agreement.

In Korea, President Yoon put a temporary halt to short-selling last year. Until then, I vaguely knew that it was short-selling that drove all the ordinary “ants” out of the stock market, which had been left frozen. His measure blew life into the Korean stock market again. Sadly, I did not know until I looked up that term upon reading my article. Now I understood why my dad asked me to sell the stock if it was in the list of short selling. I cannot agree more how important it is to start working on financial literacy because it is everywhere and controlling my economic activities in this world. It is just a smart way to live. I even think that it must be an official language course to take under the name of “Financial Literacy as a Second Language” — FSL 101– because it is indeed everywhere where money goes.

Hello Yujing,

Your reflection on the financial literacy and experiences of your granduncle, Jie, offers valuable insights into wealth management, and past economic condition in China. I truly agree with several points you raised, particularly the notion that “money is only a current medium of exchange” and the disruptive effect that inflation will cause on people’s purchasing power. However, I would like to delve deeper into some of your aspects and provide some of my additional perspectives.

Firstly, I truly appreciate the remarkable success your granduncle achieved. Leaving Fuzhou for Hong Kong in the early 1980s and amassing a substantial fortune within a decade reflects his entrepreneurial spirit and hard work, he also had a great investment insight in choosing an optimistic market that offers a pool of opportunities for his startup business. However, his initial decision to deposit all his earnings in a bank was only lucky for the time, considering the sense of security and guaranteed interest return the banks offered. Yet, as you noted, this strategy had failed to work in later years as it fail to keep pace with inflation, leading to a decline in the purchasing power of money. However, as Professor Olivia S. Mitchell has mentioned, a range of different financial literacies are critical for effective risk management. Based on the concept of the time value of money that we’re currently learning in the Essentials of Finance Wharton Global Youth Program, using discount rate to work out the present value of future cash flows helps assess the true worth of an investment today is essential for planning long-term financial goals to mitigate any risk and opportunity cost. As an alternate investment, I believe purchasing US treasury bonds alongside with saving money in a bank will definitely gain a higher income and a long term stability, since it’s considered to be risk free and offers a much higher interest rate to its investors.

Secondly, your granduncle’s regret over not investing all his money in real estate will surely considered to be at high risk as he’s overreliance on a single market only. While real estate can offer substantial returns, it is inherently risky to allocate all funds to one asset class. I believe diversification is an essential financial strategy as it mitigates risk by spreading investments across various asset classes. This strategy not only enhances potential returns but also reduces the impact of market volatility on an individual’s portfolio. Investing in Real Estate Investment Trusts (REITs) offer a viable alternative as they provide regular income through dividends and potential capital gains while maintaining liquidity. Additionally, mutual funds and Exchange Traded Funds (ETFs) also allows for diversification across stocks, bonds, and other securities. Managed by professionals, they reduce individual risk and provide exposure to various markets and sectors.

Overall, we can see the importance for diversified investment strategies and the importance of various financial literacies to mitigate and reduce risks as mentioned by Professor Olivia S. Mitchell. By diversifying investments and leveraging financial knowledge, investors can better apply risks management and achieve sustained financial stability; by monitoring free cash flow, it provides insights into a company’s financial health; reading and analysing financial statements enable investors to evaluate a company’s performance and identify potential risks; and understanding amortisation schedules is vital for managing equal payments between identical time periods. A comprehensive approach and understanding to financial management are essential for a stable and thriving financial future.

Professor Mitchell, thank you for tackling the difficult task of bridging the gap between high school students and financial literacy. Nowadays, teens are growing up faster; in this cruel timeline, we have to worry about global politics and the end of the world while juggling school, work, social life, and physical and mental health. With all this clutter in our minds, there leaves little space for us to be aware of our spending habits and futures.

When I was a kid, I remember begging my father to buy me ice cream from the ice cream truck: more specifically, the SpongeBob SquarePants popsicles. The icy treat was always a delightful reward for the multiple laps around the playground my friends and I would run. My favorite part would be to chew on SpongeBob’s black gumball eyes and compete with my friends to see who could blow the largest bubblegum bubble. Life was good and simple back then, but you know what they say, right? “Ignorance is bliss.”

Prior to Thanksgiving weekend, I regularly helped my mother out in our family-owned laundromat. Like any other Saturday, I hopped into the car with my mom at seven in the morning to clock in at our laundromat. Nothing was out of the ordinary. We used the metal rod to open up the storefront, collected quarters from the machines, and waited for customers to trickle in. At lunchtime, I made a trip to the local Dunkin’ Donuts; I got a bacon, egg, n’ cheese bagel sandwich for myself, a cream cheese bagel for my pescatarian mother, and dollar hash browns with iced coffees for us to share.

But in the afternoon, the fire alarms in the residential area above our laundromat began blaring. The incessant beeping caused immediate panic. Customers, my mom, and I immediately rushed out to the front to see what was happening, and we were at a loss for words. Smoke was curling out of the second floor, infiltrating our laundromat, and engulfing the entire room in a sheet of black within seconds. Despite my warnings, my mother scrambled back into the laundromat to take everything of value while I stood outside, dialing 911 with trembling hands. As the firemen finally came, they unfortunately exacerbated the damage to the laundromat with high water pressure hoses. That day, my mother and I could only helplessly watch as our family’s livelihood dissipated before our eyes.

Now, more than half a year later, we have yet to get back on our feet. Although my mother did manage to receive some support from her insurance, the laundromat is still in repair, more than eight months after the catastrophe. My family is still relying heavily on our emergency funds, and without this backup cash, we probably would’ve lost everything.

Personally, I have unknowingly applied many of Professor Mitchell’s “truths” to alleviate the financial burden that had been dropped onto my parent’s shoulders. For instance, truth three calls the reader to “plan better, budget better, [and] save more”. I have done exactly that. To help me become more aware of my everyday expenditures, I created a budgeting spreadsheet. Every single day, I mark down how much money I spend on transportation, grocery store runs, online shopping, and midnight fast food snacks. Then, through basic Excel operations, the spreadsheet shows me my total expenses, total income, and my net gain or loss for the month. I’ve now made intangible numbers concrete, and it has helped me change my lifestyle dramatically. I have minimized the amount of dinners with friends, impulse purchases, gifts, hangouts, and—most reluctantly—SpongeBob popsicles. Today, saving money and counting pennies has become more than just necessary for me; it has become a hobby!

I urge all of my peers, along with Professor Mitchell, to take similar steps in safeguarding their uncertain economic future. I know that I am not the only teen that has suffered through desperate and difficult times, and the cruel reality is that anything can happen in life. For all you know, your car could be struck by lightning tomorrow without warning; even if you aren’t in a dire situation now, it is still essential to budget, buy insurance, and put money into an employer-matched 401(k)—all in order to prepare for the future. By being financially literate, dreams do not remain as simply dreams; they transform into goals instead.

In the future, I hope Professor Mitchell can continue educating us on financial literacy by breaking down the topic of credit. One of the first things that teens do when they reach 18 is apply for a credit card from their preferred bank of choice. With prefrontal cortexes that have yet to fully develop, teenagers are notorious for splurging on designer brands, fine-dining, and concerts—on lended money, no less. As the years go by, these teenagers age into adults who wind up living paycheck to paycheck and making credit card payments for the rest of their lives. My cousin is a prime example. He is a student at UAlbany, and he had made the mistake of being too trigger happy with his credit card during the first few years of his freedom. Now he has to juggle payments for his tuition, rent, credit card bills, car insurance, and everyday spendings. On the other hand, I have seen influencers on social media brag about how they exploit credit card benefits: gaining points on every dollar spent, getting money back from purchases, and going on free, business class flights. For me, I would prefer to learn this tips and tricks from someone like Professor Mitchell than a random digital creator.

Thanks, David, for your insights and personal experiences! I wish you and your family the best in rebuilding your family’s laundromat business. But from what you’ve described about your current financially literate actions, it seems like you are on the right track.

Now, Dr. Mitchell’s ten truths are absolutely useful for building stable long term finances, but may lack a bit of advice for dealing with more niche factors. For example, truths 7-9 of the ten focus heavily on investment returns and retirement, while the earlier truths revolve more around building financial literacy and risk management. These are all things that can be easily controlled by an individual, and are probably the most useful in building stable long term finances, but are less applicable with dealing with key choice cases. What I mean by niche factors are things such as interest rates on student loans and mortgages, and maintaining a competitive credit score. Things such as transportation ownership and maintenance, and depreciation over time. Such information for dealing with these peculiar situations, while not as general or long term as the ten truths outlined in the article, are still incredibly impactful for good financial decisions.

So, especially in the case of your cousin, David, I really don’t think the ten truths or more credit advice is enough. Credit card debt, or other credit related issues, are as much of an interest problem as a risk management one, and is often compounded by interest in student loans or vehicle expenses or other areas. And to build good habits, especially in these other choice areas of finances, is absolutely essential at these crucial years of entering adulthood.

One thing we can agree on is the questionable legitimacy of social media influencers. I would recommend researching more of Professor Mitchell’s financial advice. Thanks for sharing!

1. About 500 dollars in the next 5 years

2. I think I would buy the same as today

3. Flase

Professor Mitchell’s talk really opened my eyes to how important it is to understand money and start planning early. One thing that hit me was when she said people could live to 100 or even 200 someday, it made me realize that saving isn’t just about the short term, it’s about making sure you’re set for a really long life. I’ve never been great at saving, but hearing her explain how much you actually need to put aside for retirement if you start late really made me think. It’s not just about having money, it’s about knowing how to manage risks, like losing a job, getting sick, or living longer than expected. Financial literacy helps you make smart choices now so you’re not stuck later, and that’s something I want to get better at. Her lecture definitely motivated me to take this stuff more seriously and start figuring out a better plan for myself.

I think financial learning helped me understand different aspects from it that I never knew about till now.