Learning to Use Financial Accounting Numbers Strategically

Catherine Schrand, a professor of accounting at the Wharton School of the University of Pennsylvania, gets what you really think of her. “I know the reputation of accounting,” she told a group of high school students visiting Wharton’s campus during our summer Cross-program lecture series. “I know that we are seen as a boring group of people.”

Dr. Schrand fights that stereotype. Accounting is her life’s work and her research interest. Accounting, she said, is like financial forensics; it requires deep investigation into how companies operate and is about uncovering the hidden stories behind the numbers. “Accounting is the preparation and generation of information and the aggregation of that information in a way that’s useful in decision-making,” noted Schrand. “People think accountants are all about preparing accounting information, but I focus on actually using that accounting information to make decisions.”

Dr. Schrand fights that stereotype. Accounting is her life’s work and her research interest. Accounting, she said, is like financial forensics; it requires deep investigation into how companies operate and is about uncovering the hidden stories behind the numbers. “Accounting is the preparation and generation of information and the aggregation of that information in a way that’s useful in decision-making,” noted Schrand. “People think accountants are all about preparing accounting information, but I focus on actually using that accounting information to make decisions.”

Here are 4 ways Professor Schrand talks about using financial accounting information (see sidebar below) as a strategic tool for understanding a company’s true financial health and potential:

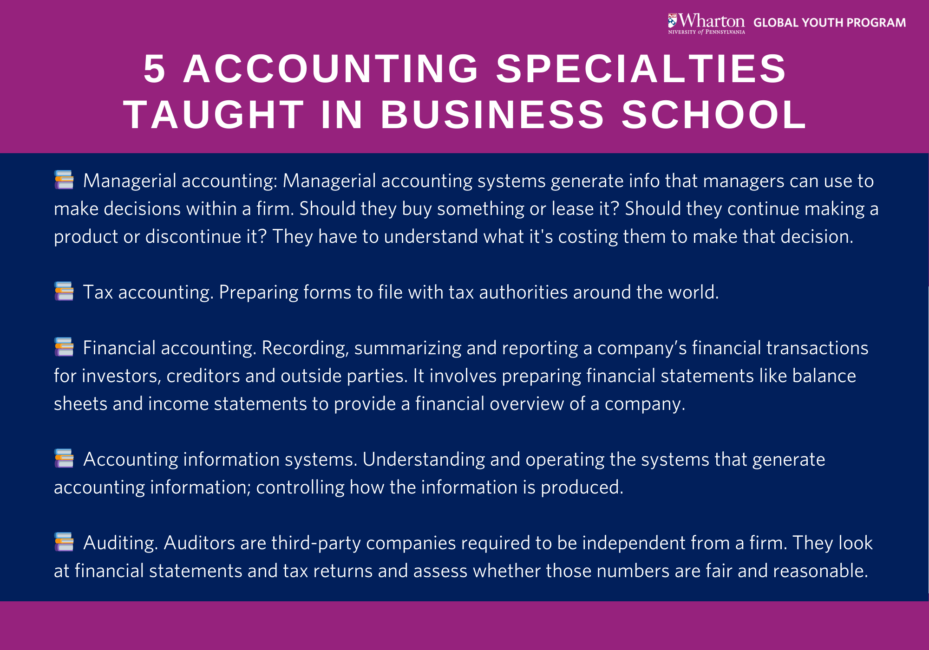

💰 Equity valuation. What is the fair value of a public company’s stock? Investors are hungry for this information as they figure out where to put their money. Investors use accounting data, particularly earnings, to forecast future cash flows and use discounted cash flow valuation models. Small changes in earnings persistence (the continuity of earnings from one period to the next) can dramatically impact a company’s valuation. “It is true based on research, that earnings, current period earnings, are a better predictor of future period cash flows than current period cash flows,” noted Schrand.

💰 Disaggregation techniques. An income statement aggregates accounting information, meaning it combines financial data from different sources into a consolidated view. It’s important to analyze disaggregated components like Research and Development (R&D) expenses, income taxes, and interest expenses to understand a business and to get at why, for example, certain earnings are likely to persist. “Financial statements are highly aggregated,” said Schrand. “But the standard setters do require certain items to be disaggregated, and they’re meant to be helpful to people who are trying to forecast future cash flows.”

💰 Analyzing managers’ decisions. Company managers can influence reported earnings in different ways, in particular structuring transactions for accounting benefits. What are the numbers telling you that might obscure or distort the true economic position of a firm? One example is reporting of research and development, an important innovation arm of a company. “There’s a lot of evidence out there that managers, if they want to show higher earnings, reduce their R&D,” observed Schrand. “Every dollar of R&D that you save increases your earnings by $1. Is that a good business decision to reduce R&D? How are you going to grow in the future if you’re not developing new things? But it makes your earnings that year look better.”

💰 Knowing the risks. Accurate risk assessment for analysts and investors depends a lot on understanding how accounting works – not just reading the surface numbers, but also interpreting what they represent. For example, Dr. Schrand, whose research focuses on earnings quality, said that not all earnings are equal in terms of persistence. Earnings that come from unusual or non-recurring events (like a legal settlement) are less reliable predictors of future performance. Higher-quality earnings translate to lower risk.

Concluded professor Schrand: “You need to understand the business model of a firm in order to be able to interpret its income statement. But on top of that, you need to understand how the accounting represents their business activities.”

I found it interesting that earnings are usually a better measure of future cash flows than cash flows themselves. I was surprised at first, but then the idea of earnings persistence makes so much sense. If a company has consistent earnings for a long time, it gives investors somewhat of a reasonable basis to rely on those earnings and project into the future. This is also part of the reason why, in some cases, even very tiny changes in earnings can have such large impacts on the value of a stock. I wonder what happens with companies where earnings are known to be unpredictable, such as startups, tech companies, etc. Do earnings have more value in those situations, too?

For startups and tech firms, earnings aren’t that useful. Amazon went over 20 years without consistent profits and still gained massive value. Same with Uber. Constant losses, huge valuation. Investors focus more on growth, market potential, and user data than earnings.

DCF can still apply, but it relies on projected revenue, not historical performance. So no, earnings do not carry the same weight. It is not about persistence. It is about potential.

Hi Aarav, great observation! You’re right — earnings persistence really helps investors feel more confident about future cash flows when a company shows steady, predictable earnings over time. For startups or tech companies, where earnings can be volatile or negative due to heavy investments and rapid growth phases, the situation is definitely trickier.

In those cases, investors will look beyond current earnings to other indicators like user growth, market share, or technological breakthroughs. They may rely more on forecasts, R&D expenditures, and potential scalability rather than just historical earnings. The “quality” and context of earnings truly do matter — that is why, as Dr. Schrand points out, understanding the business model and accounting nuances is the path to making smart decisions, especially with companies that do not yet have consistent earnings.

Thanks for bringing up this interesting question! It truly illustrates how financial accounting is not just numbers, but a narrative of the company’s future and present.

It’s crazy how much managers can shape the story behind the numbers especially with things like R&D cuts just to boost short-term earnings. That’s a red flag for real growth and long-term value. Accounting isn’t just about numbers on paper it’s about understanding the real business beneath them. If more people dug into this investors wouldn’t get played by flashy but hollow earnings.

I know right? This article really shed light on how companies can inflate their “earnings” by using strategies that will ultimately just hurt themselves in the long run as departments like R&D are essential for not only creating new products and things of the sort but also staying on top of the latest trends, which increase the company’s outreach. And while I do agree that more people looking into this would be nice, in the end, it’s the responsibility of the investor to make sure they put their money in the right spot. However, if by “dig into”, you meant more people talking about this discrepancy and illuminating this backwater part of entrepreneurship, I completely agree.

Hey Tanisha,

I really enjoyed reading your comment and listening to your perspective on this article.

I agree with your comment about how managers can manipulate short-term numbers, especially through R&D cuts used to boost short-term earnings. I also noticed how the article highlighted this as a way financial statements can be misleading in the eyes of the public. I like how you said that it was a red flag when companies focus on short-term earnings instead of long-term growth!

However, the article doesn’t only warn us about the manipulation of business reports. It encourages us to not only spot those red flags, but learn how to make more informed decisions. It stresses the importance of understanding how different people (managers, investors, etc.) interpret financial information to make better decisions.

You mentioned that more people should look past flashy earnings, and I definitely agree. I think learning how to read key metrics like cash flow, operating income, and return on investment gives investors and consumers the ability to tell whether a company is actually beneficial in the long-term or just chasing short-term profits.

Your perspective is really strong and expanding your thoughts can lead to deeper discussion on how financial literacy inspires more ethical decisions in business!

Accounting gets a bad rap. Mention it in public, and you might get the same reaction as if you’d just declared a love for watching paint dry – especially if that paint is on spreadsheets. But Professor Catherine Schrand is on a mission to rescue accounting from its “boring” reputation, and trust me, she makes a compelling case. Under her guidance, accounting isn’t dry number-crunching; it’s financial forensics. Think Sherlock Holmes, but with spreadsheets and income statements. She’s not just teaching math; she’s teaching how to decode the hidden stories companies tell through their financials.

Professor Schrand offers four sharp strategies to turn financial accounting data into something truly useful, like making smart decisions instead of expensive mistakes. Take equity valuation: she shows how looking beyond today’s stock price and into a company’s current earnings can reveal tomorrow’s cash flows. That’s not just a prediction, it’s like a superpower!

Then there’s disaggregation, which is basically ripping the mask off those neat consolidated reports to figure out what’s really driving performance. R&D spending? Market dynamics? You’ll find out. Furthermore, she sheds light on analyzing managers’ decisions, showing how accounting choices can sometimes obscure a firm’s true economic health. Finally, she tackles risk, not the kind you take when you assume your phone is charging because you “definitely plugged it in,” but the kind that significantly impacts earnings quality and long-term business health.

Ultimately, what Professor Schrand proves is this: accounting isn’t about adding things up; it’s about pulling things apart. It’s the crucial difference between looking at a company’s numbers and understanding them. It’s for people who want to know what’s really going on behind the data and make smarter financial choices because of it. So no, accounting isn’t boring. Not when it’s taught like this. It’s detective work with a calculator.

Hey Neil, Loved your take, especially the “Sherlock Homes with spreadsheets” line! Professor Schrand really does reframe accounting in a way that makes it feel like detective work, not just number crunching. I totally agree that accounting isn’t about adding things up, it’s about breaking them down to understand what’s really going on inside a business.

What stood out to me most was how she focused on using accounting info to make decisions. It’s not just about preparing the data, it’s about reading between the lines, especially when managers make choices like cutting R&D to boost short-term earnings. That’s legal, sure, but it could be misleading too. Shouldn’t we be teaching people to interpret those choices critically, not just accept them?

Also, the point about disaggregation is huge. Financial reports can hide a lot if you don’t know how to dig deeper. But how many people actually know how to do that? It feels like we need more education on how to read financial statements, not just what they are.

I’d even argue accounting should evolve more. Maybe including more transparency around management decisions or long term tradeoffs. Schrand makes it clear that accounting isn’t just about money, it’s about people, strategy, and risk.

Neil, your “Sherlock Holmes with spreadsheets,” comparison is a masterpiece.

But if we examine accounting from a different perspective, it is less like reading a mystery novel after it has already been written. Instead, it’s more like writing the novel in real time, anticipating the plot twists before they happen. Dissecting R&D expense trends, for instance. It can be the key to the Tesla of tomorrow before the headlines break. Or how analyzing management’s choice reveals whether you’re seeing real innovation or just creative accounting.

The real magic, though it is in the competitive edge the accounting mindset gives us, not just for investing, but for entrepreneurship and politics. When you see numbers as signals, or sometimes even as smoke screens, you’re able to outmaneuver “headline readers” that everybody sees and spot opportunities early, earning the market share.

To anyone who sees accounting as background noise, they’re missing out where the real action starts.

With the pipeline of new accounting graduates dwindling and retention of existing professionals dropping, the accounting profession faces a crisis. However, as you astutely note, Neil, accounting may be suffering more from a perception problem than from actual decline.

Branded as a profession of “bean counters,” accounting has lost appeal to students drawn to “flashier” careers like data science or entrepreneurship – roles often viewed as more creative and impactful. Yet this view underestimates accounting’s true potential. Accounting is the strategic backbone of businesses, governments, and economies, and today, emerging technologies are redefining what it means to be an accountant.

As Dr. Catherine Schrand says in Learning to Use Financial Accounting Numbers Strategically, today’s accountants are not just managing numbers, they are “uncovering the hidden stories behind the numbers.” Real-life detective work. That’s why I appreciate your “Sherlock Holmes with spreadsheets” analogy, turning the accountant into an investigator, strategist, and trusted advisor. This rebranding is exactly what the profession needs to emphasize: high-value, high-impact work. And this rebranding must also reflect how technology is redefining the accountant’s role.

As highlighted in another Wharton Global Youth article, “How Will AI and Hybrid Work Change Your Job?”, AI is not here to replace professionals, but instead, it offers the possibility to reshape roles. Blockchain auditing and AI-powered analytics can take over more mundane tasks, freeing even early-career accountants to focus on deeper analysis and strategic decision-making. By embracing this shift, accountants can evolve into more agile, tech-savvy professionals, hopefully making the field more attractive to the next generation.

Ultimately, the current talent shortage is a chance to reframe the narrative, modernize its reputation, and fill the pipeline with purpose-driven professionals ready to reshape the future of finance.

I loved this article! I’m a student in the CFA Investment Foundations program and I am studying about investing in stocks. I like Professor Schrand’s concept that accounting teaches us about money by discovering what the numbers actually say. I do something similar with NeuroEd, where I observe data to determine how engaged students are and how fatigued they become.

I enjoyed the concept of decomposing numbers. Similar to Schrand’s recommendation that R&D and tax expenses be separated, I break down user activity data, such as test scores and task duration, to enhance NeuroEd’s customized learning sequences. The in-depth data, such as identifying stocks that yield consistent returns rather than quick profits, assist investors like myself and educators in comprehending actual performance.

I consider risk and earnings quality while thinking about stocks. I review normal profits and unusual gains. I do this so that I may know when users are dropping off. I ensure NeuroEd’s AI does not mistake genuine disengagement with random behavior.

Thanks for the reminder that various kinds of numbers—such as financial statements and app usage information—tell a larger story. I will keep this in mind when I study for my CFA, make investment decisions, and develop NeuroEd.

Professor Schrand does a fantastic job of breaking the stereotype that accounting is boring. It’s honestly really refreshing to hear her talk about it as if it’s a form of detective work; it was something I haven’t heard it being described as. This perspective highlights how accountants do so much more than just crunch numbers (for as much of a funny visual as it is); they help reveal a company’s finances. I loved her insight about how managers might skew reported earnings by cutting back on R&D. It really showed how important it is for investors to dig deeper into the motivations behind the numbers.

I completely agree Professor Schrand’s perspective really reframed accounting for me too. I used to think of it as just spreadsheets and formulas, but comparing it to detective work highlights how it’s actually about interpreting human behavior through numbers. Your point about R&D cuts is so important because it shows that the “story” behind the numbers matters just as much as the data itself.

To build on this, I think this mindset applies beyond accounting it’s relevant to any field where decisions affect people’s trust. Whether you’re an investor, consumer, or even a student leader managing a budget, understanding the “why” behind financial choices can help us make better, more ethical decisions. It’s a skill I’d like to build more intentionally.

Right, Dr. Schrand’s description of how accounting is almost “detective work” really reminded me of the importance to use accounting to really dig deeper. What I think is the most intriguing part of accounting is actually figuring out what companies are doing and actually how much they are willing to inflate and exaggerate their total earnings and income. Your example reminded me of a case study I did in an intro to Business class of Enron.

Enron, a seemingly stable and incredibly powerful energy trading company claimed to be the future of global energy and business models. They would use their newly created business model “mark to market” to fabricate deals and create money out of thin air on the premise that they would eventually earn that amount of money back. However, through accounting, many professionals eventually caught on that Enron was not financially capable of doubling or tripling their sales within such a short period of time, which eventually led to their downfall.

This article is an incredible glimpse into how accounting isn’t just number-running—it’s a strategic language that communicates performance, makes decisions, and creates stakeholder trust. Its interpretation of income statements and balance sheets as narratives resonated with me most: every line is telling a story of priorities, utilization of resources, and intention forward.

One specific thing that resonated was the interplay between margins and mission-based growth. The article shows how operating and gross margins analysis will tell you if a business is making or burning cash for short-term growth. That reminded me of a fintech proof-of-concept I worked on—where we built a user acquisition model in AWS using Python and SQL to estimate profitability. When we reduced marketing expense by a small amount, our variable margin increased by 8 percentage points—not just breaking profit—but demonstrating strategic growth discipline.

I also liked the article on cash conversion cycles and working capital management. In one of the case studies, a tech firm extended payables to create cash flow, but the paper rightly warns that this can strain supplier relationships. When interning with Bhoomika Trust as a nonprofit, I helped align delayed grant payments with cash inflow by building a simple rolling forecast in Google Sheets. The result: a 20% reduction in annual funding delays—without losing any partnership or operations. That pragmatic lesson echoes the article’s point to perfection—working capital is not necessarily about numbers; it’s relationship economics.

Another key insight: leverage ratios and capital structure don’t just reflect risk—they signal strategic intent to investors. A higher debt ratio might indicate aggressive expansion, while equity conservatism might signal long-term sustainability. As someone exploring impact-driven fintech, I’m curious: how can early-stage climate-tech or social enterprises use financial statements to simultaneously show mission commitment and business credibility to skeptical financiers?

The article concludes on a wonderful takeaway: accounting literacy is leadership literacy. I couldn’t agree more. As how I helped design dashboards—automated AWS reports with graphical KPIs—for donor stakeholders, learning financial statements provides leaders the clarity to set strategy, establish expectations, and forecast responsibly.

My query to the community: What actual tools or frameworks have you used in bridging the space between the abstract world of financial accounting and mission-oriented storytelling—whether student ventures, nonprofits, or classroom exercises? Are templates or software (e.g., QuickBooks projections, venture pitch models, or cloud-based accounting apps) that helped you transform numbers into effective, strategy-driven storytelling?

Thanks for this splendid lesson. It is not just about learning to count, it is about learning to lead.

The importance of accounting is often overlooked. Known as the language of business, accounting is crucial to prevent financial losses and keep a company solvent. Finance relies on accounting, which highlights its essential role. The use of accounting in equity valuation alone should spark interest among investors. To determine if a company is worth investing in, people must understand the balance sheet, income statement, and cash flow statement—all core elements of accounting. While I’m more drawn to finance, I recognize accounting as the engine that drives a company. Nearly every business decision requires accountants’ input to ensure the company has enough funds or to figure out how to secure them if it doesn’t.

“Accounting is the preparation and generation of information and the aggregation of that information in a way that’s useful in decision-making.” When I read this quote, I thought about my microeconomics class. In that class, my teacher always emphasized one key idea: efficiency. If he had the choice to rename the class, he would name it Efficiency 101. He would always say that we learn economics to figure out the decisions that businesses make to make themselves more efficient. Now that I see that Dr. Schrand also talks about decisions. It makes me wonder, what exactly is this field of work: Finance, Economics, Accounting, Business? I believe this field is simply understanding the interactions of the human race mathematically. I also believe that is what Dr. Schrand is trying to convey. If people understood that Accounting is just like betting on a sports game, would the stereotype exist?

I initially assumed accounting was boring and meant for geeks. However, as I have learned a bit more about the world of finance and investing, accounting has proven to be invaluable. As Professor Schrand mentions, accounting helps us see past manipulated numbers. What resonated the most from this article was how accounting helps give you the true picture of the financial health of a company.

A few stories in particular prove the importance of accounting. In the 1990s to the early 2000s, WorldCom was one of the biggest long-distance providers in the United States. Founded in 1983 after the breakup of AT&T, the company quickly became one of the biggest long-distance providers. Its downfall began when it pursued acquisitions aggressively, buying out rival companies to gain market share. Dropping revenue further put WorldCom in the red. In order to not lose investor confidence, it used questionable and illegal accounting techniques a.k.a cooking their books. The company recorded its expenses as investments, and by capitalizing these “investments”, it inflated a net loss to a net profit of $1.38 billion.

One particular person, Cynthia Cooper, Vice President of WorldCom’s internal audit department, noticed something terribly wrong with WorldCom’s income statements. She even found out that WorldCom fired a different employee who questioned WorldCom’s capital expenditures. She and one other person lead an investigation, and WorldCom was caught in the midst of its lies. Just like that, $186 billion of market capital was wiped out to zero.

Another fraudulent company busted by accounting was Enron. Founded in 1985, Enron was a company that specialized in energy and commodity trading. At its peak in the late 1990s to the early 2000s (like WorldCom), it was one of the biggest US companies in their industry, praised for their rapid growth. However, as other companies started taking market share in Enron’s industry, their key financial metrics started declining.

Instead of acknowledging this, Enron used illegal accounting methods to appease its investors.For instance, it booked future contracts as current earnings, even though it hadn’t received the profit yet. This made Enron look more profitable than reality would suggest. Enron’s management shifted Enron’s bad assets and debt to hundreds of shell companies, keeping it off their balance sheet, tricking investors into thinking the company was healthy. As if that weren’t bad enough, Enron inflated earnings to help increase the stock price, and their CEO and chairman sold the stock for millions while encouraging others to keep buying.

In the late 2001s, analysts started to uncover inconsistencies in Enron’s financial reports. They were also caught destroying audit documents, resulting in the demise and bankruptcy of Enron. Investors lost over $60 billion.

While many people think of accounting as boring, I believe it’s incredibly important. The stories of WorldCom and Enron show just how crucial accounting is. It played a key role in uncovering these frauds and protecting investors from great losses.

Growing up I was always interested in the field of accounting, and found it interesting how it ties into the world of Finance. I constantly asked the adults around me about the field, despite them not having careers in finance. I always got the same response along the lines of, “Do you want to spend all day inputting numbers into a spreadsheet? You should think of doing something more Thought-provoking than that.” This always left me discouraged about accounting, despite wanting to understand and learn so much more about it.

It is only now as I grow older, and look at the world through a matured lens that I see how essential accounting is in determining the economic state of the world. I think that Professor Schrand perfectly highlights the most essential pieces of accounting that create the nearly trillion dollar industry. When talking about equity valuation, Professor Schrand sheds light on the interdependence of the stock market, and the accounting industry. The stock market relies on accounting departments from each corporation to accurately value stocks. Due to this, and the overall importance of accounting it is essential that all corporations follow the GAAP, the Generally Accepted Accounting Principles, these standards, and laws govern all forms of accounting in the USA, and ensure financial safety for all people by ensuring transparency in financial reporting.

One event that I remember from 2020, always reminds me of how essential accounting really is. The Chinese coffee chain Luckin Coffee was caught reporting fake sales on their Financial documents, and inflating expenses. This caused them to be delisted from Nasdaq, and fined 180 million dollars, which caused them to file for bankruptcy. This was all caused by the Chief Operating Officer of the company. This not only ties into the equity, and valuation of the company, but also into how a manager’s decisions can affect the Financial statements of a company.

Overall Professor Schrand makes an excellent argument about how accounting really is the forensics of finance. I am happy that over time I have gotten to learn how essential the field is to the entire finance industry, and how it serves as the backbone for the way we value companies, and stocks. I now feel like I have the perfect response to the people who think accounting is simply numbers on a spreadsheet.

It’s really interesting to see your perspective! Unlike you, I grew up having no interest in finance or anything business related despite both my parents having majored in finance and their previous working experience in accounting. I felt personally discouraged about business because of my dad’s work that required long hours away from us everyday. It made me feel almost resentful towards finance. Just like you mentioned, becoming more mature also offered me a different lens as I revisited finance and accounting- seeing their positives now that I am older. I started asking around more and how I could prepare myself to be ready if I were to take that career path. This article added on to my previous knowledge regarding accounting, other than the conversations with my dad and my own research, this article offered a deep dive into many other aspects

On a different note, I find it interesting that you mentioned the Luckin Coffee scandal as I recall coming across that a couple of years ago when I lived in China. Both my parents, being big fans of Luckin Coffee, brought up the news a lot in discussion during our family dinners. Reading this article reminded me of how I viewed accounting and similar business related topics as a kid. I’m glad that I was able to mature and see the value that accounting and similar business related industries brought to the world.

Before reading this article I didn’t realize how much strategy is involved in interpreting the financial data of a firm. I liked this article and how Professor Schrand talked about the strategic use of financial numbers. Just thinking about it changes my aspect for planning, investing and managing money. Currently I study accounting and now I realize the actual importance of understanding and applying accounting data in decision making. I really thought financial statements only decided profit and losses. The type of business firm is really matters and the returns are measured based on it.

Great take Dibyansu! I agree with your views on accounting helping with decision making. A good ledger can truly shape a clear mind for the future of a firm/business. It is vital that accounting is thought of as important, so it can be used to manage and understand businesses.

Having had very little experience, but a lot of stereotypes engraved in my skull regarding accounting, this article helped me remind myself of the true weight of this field of study. Accounting has unknowingly been an area of interest for me since I was little; those around me – be it teachers or relatives – regularly exclaimed my particular talent in organizing anything and everything in my life, which led eighth-grader me to believe that accounting could be a plausible path for me. Fast forward to my Economics class, in which we started learning the basics of accounting, I immediately realized that this subject was not as straightforward as it seemed. Whilst calculating the indirect tax paid by John, the only question that circled my mind was: “Why am I doing this in an Economics class?” However, after considering Catherine Schrand’s point of view, I discovered that accounting, although tedious, is an essential component of nearly all subjects related to economics or finance. When we step out of the classroom and look at the big picture, accounting does really act as “financial forensics,” which plays a key role in running large companies, some of which we might encounter on an everyday basis. I believe that breaking down the merits of accounting, whether it be enhanced risk assessment or better forecast about future cash flows thanks to disaggregation, helps others (especially those struggling with base-level accounting), to realize that accounting is truly not just about the numbers, but it is the backbone that helps maintain numerous businesses globally.

A few years ago, before I dug deeper into business, I didn’t fully grasp the importance of accounting either. Now, I see it as the foundation for studying finance or economics. Without the basics, you’re lost. Accounting is what keeps businesses—big or small, even scrappy startups—running smoothly.

I totally agree with you that accounting is the backbone of virtually every business out there. Companies shouldn’t skimp on hiring the best accountants. It demands sharp, responsible people because accountants can’t afford to mess up.

If you’re still interested in an accounting career, I say go for it. Like Professor Schrand points out, accounting doesn’t always have the best reputation and it’s tough, which makes good accountants hard to find. A bad accountant can lead to fraud, massive public backlash, and huge financial losses. Plus, no one knows the numbers like an accountant—their insight is critical. CEOs, and especially CFOs, need to consult them directly for strategic decisions.

I really enjoyed reading this article as a rising sophomore who is diving more into business related topics. Professor Schrand disproves the boring reputation that is given to accounting by demonstrating its real world application. This article shows that accounting is not just a boring subject based on analyzing numbers, it’s a complicated system that helps businesses make crucial decisions.

Professor Schrand offers multiple approaches to accounting that turns the data gathered into something that is useful. For example, the one that stuck to me the most was equity valuation, it’s the cornerstone of investing and financial analysis. It’s essential to investors, analysts and company management to understand the financial health and potential of a business. She shows how by analyzing the data from the past and the present, they are often able to predict the outcome of future financial performance which in return gives investors an insight into future earnings and potential losses of said business.

I also enjoyed reading about risk management and disaggregation techniques, two topics are just as useful as equity valuation is to investors and analysts. Disaggregation techniques are used by companies to evaluate certain components and determining the performance and potential for each of them. It’s used by analysts to understand which parts contribute the most or least to profitability. It transforms raw data into something used by company management to reveal the performance and profitability of each individual component. On the other hand, not all earnings are equal and understanding this is crucial for effective risk management. Understanding the risks is critical to investors and analysts. As stated in the article, the consistency and reliability of a company’s earnings are direct indicators to a company’s future earnings and at the same time, its risk profile. It requires a deep interpretation of the analytical numbers that provides investors and analysts with a deeper understanding of a company’s financial stability, its potential for growth and the quality of its earnings.

In conclusion, Professor Schrand indicates that accounting isn’t just simply collecting data and using the raw numbers, it’s about diving deeper and using the numbers to gain a better understanding of a company. I really enjoyed this article and it truly opened my eyes to the importance and value of accounting in our daily lives.

When Professor Schrand said that accountants are often seen as “a boring group of people,” I really felt that. I’ve experienced that same stereotype, and it’s frustrating. People often say, “Accounting isn’t good, it doesn’t earn you much money,” but being interested in something isn’t only about the money, is it? Accounting is a basic necessity in everyday life—even something as simple as basic data entry involves recording information that influences decision-making.

Though this might be irrelevant, I’m interested in finance, and I can’t imagine it functioning without accounting as its foundation. It’s unfortunate how overlooked and undervalued accounting can be, especially considering how essential it is to making informed decisions, as Professor Schrand rightly points out.

Funny enough, people call accounting boring because it involves recording numbers—yet they obsess over numbers like likes and followers. That just proves how much numbers really drive everything, even if we don’t always admit it.

I truly wish that one day accounting receives the respect it deserves—it plays such a vital role in our world. And just to break the fourth wall for a moment: whether you’re reading this or not, I hope you have (or had) a fantastic 4th of July!

Most people treat accounting like a rearview mirror. a way to analyze the past. But in high finance, the best use it as a steering wheel. Financial accounting isn’t for just tracking performance. It’s a tool we are able to use to shape the narrative, guide investor psychology, and control outcomes. That’s what separates those who read numbers from those who manipulate markets.

Professor Schrand’s way of disaggregation, managerial decision making, and risk showed me how earnings can tell certain stories. It reminded me of when I analyzed two identical looking companies during an investment club session, same revenue and earnings per share. But one was able to bury R & D cuts behind smooth quarterly growth, and the other burned its short term profit to build long term moats. If u dont look deeper, it’s easy to pick the loser.

I realized this again while earning my Bloomberg Market Concepts certification and applying it to my Schwab portfolio. “Earnings persistence” sounded simple until I saw how one time events or quiet cost-cutting could inflate perceived stability. The best companies don’t just perform well, they perform well in a way that looks good on paper. There’s a difference. And if you can’t spot the difference, you’ll get played.

For me, accounting isn’t about accuracy. It’s about control. Political campaigns shape polls and Companies shape earnings. The numbers might be real, but the stories built on them are chosen. In that way, learning to use financial accounting strategically isn’t about avoiding mistakes. It’s about learning how power plays get made behind the balance sheet.

“For me, accounting isn’t about accuracy. It’s about control.” This quote stuck with me. Let me explain, when reading this article, I, along with most, tried to find a different perspective on accounting. Most of them are exemplified in the other comments of this article. However, never in a 1000 years would I have thought of accounting as a method of control. Using accounting not just to analyze the past and present but also adds a new dimension by controlling the future. That is truly fascinating.

I grew up thinking accounting was cool, and scoffed at my elementary school friends who didn’t understand what assets, liabilities, and owner’s equity were. Turns out, it was the other way around- they were laughing at me. After falling into the propaganda that accountancy was a passionless profession, as alluded to by Dr.Schrand, I juggled between exploring different careers. Through my middle school years, I was first dedicated to pursuing a career of journalism, then an innovative civil engineer, and perhaps a passionate, world famous actress. By high school, I found myself back at home base, but looking upon accounting more like financial forensics.

It could have been the high school air, or even my mother’s dusty Mcgraw Hill Introduction to Financial Accounting textbook that I foraged through, but accounting was getting exciting again. I audited Dr.Brian Bushee’s Wharton Introduction to Financial Accounting course, shadowed tax accountants, and even devoured publicly available financial statements on the Security and Exchange Commission’s EDGAR database. Drawing the lines between different statements, numbers,liquidity ratios, and core accounting principles felt like slowly but surely solving the puzzle that made up the internal financial conditions of a company.

But what is most interesting to me when considering accounting practices may not even be the financial statements, but instead the ethics of recording financial information. Recordkeeping deceivingly can actually be law-abiding. But ethical? Since the 2008 recession, the Sarbanes-Oxley Act and the expansion of GAAP was made to fill these gaps, but as mentioned by Dr.Schrand, internal managers can still reduce Research and Development (R&D) figures in order to inflate earnings numbers. Despite the conservatism,consistency, and full disclosure principles that lay the foundation for accounting practices for the nation, deception and false indicators still arise in accounting. The only way to combat this issue is creating a more aware public, and more of an interest in the subject I consider quite cool.

When I walked into my introductory accounting class last semester, I braced for months of tedious bookkeeping. Those first weeks of balance sheets and T-accounts did little to change my mind. Then, one day, my teacher surprised us with a Netflix documentary on Valeant Pharmaceuticals. I watched short-seller Fahmi Quadir, with her short-cropped hair and nicknamed “The Assassin”, use deep forensic analysis on Valeant’s books. Suddenly, accounting wasn’t just number-crunching, it was the key to uncovering hidden stories in business.

The Valeant case crystallizes Professor Schrand’s idea that accounting is like “financial forensics”. Valeant had grown by acquiring smaller drug companies, slashing their R&D spending, and then hiking drug prices to exorbitant levels. Schrand warns that cutting R&D boosts short-term earnings by a dollar-for-dollar increase, but hurts long-term value: exactly what Valeant’s CEO did. Quadir’s analysis found that Valeant’s model was built on acquisitions and price-gouging; she said it was effectively “broken”. Within a year, Valeant’s stock plunged over 90% amid scandal, a collapse later dubbed the “Enron of pharma”.

This taught me that Schrand’s techniques are more than theory. By disaggregating Valeant’s financials (examining R&D, debt, taxes, etc.), Quadir followed Schrand’s advice that financial statements are highly aggregated and true insight comes from their pieces. Quadir conducted forensic research on companies and delved deeper after analyzing the fundamentals of their financial statements. She treated each line item, especially R&D cuts and unusual accounting entries, as clues to Valeant’s true health. In effect, Quadir embodied Schrand’s approach: using accounting details to forecast cash flows and assess risk.

In the end, short sellers like Quadir put Schrand’s lessons into action. By betting against Valeant when its real earnings quality crumbled, Quadir acted as a market watchdog and helped correct the stock’s inflated price. Her story, paired with this article, shows me that short-selling can be a public good: it enforces accountability and exposes when “earnings come from nothing”. As Schrand concluded, you must “understand the business model of a firm in order to be able to interpret its income statement”. After that class project, I realized that accounting wasn’t boring; it was the lens through which a company’s true health could be assessed and the core of our business world.

The first time I looked at a company’s 10-K, I skimmed the income statement and skipped straight to the glossy highlights. Product launches and splashy headlines felt like the real story. Earnings and line items just looked like math.

But when Professor Schrand explained how cutting

R&D might lift this quarter’s earnings while quietly eroding the company’s future, it shifted something for me. I thought back to a startup I once admired that had seemed to vanish overnight. I used to think it was bad timing. Now I wonder if the signs were in the statements all along, hidden in choices that made the short term look good.

I started going back through old filings like I was rereading a mystery novel. Small changes in how costs were classified or an odd spike in “other income” stood out in ways they never had before. There was a story behind the numbers, one I hadn’t known to look for.

What stayed with me most wasn’t the formulas. It was the realization that accounting reflects a company’s priorities. Not the ones in the mission statement, but the ones that show up when a hard decision has to be made. Do they keep investing in innovation or pull back to make quarterly earnings look stronger? Do they reveal uncertainty, or bury it in footnotes?

Now, when I look at financial reports, I find myself listening to what isn’t said. Accounting doesn’t always shine. But it does reveal. And once you start noticing how companies try to shape the story, it’s hard to unsee it.

Professor Shrand’s four ways for using financial accounting to understand a company’s financial status helped me reconsider angles of accounting that I had overlooked. As someone who wants to study finance, this framing of accounting as involving strategic thinking, interpretation, analysis, and not just bookkeeping, was eye-opening. I used to view accounting as primarily backward-looking, but Shrand’s ideas helped me see how forward-looking and predictive it can be.

The idea that “not all earnings are equal in terms of persistence” hadn’t occurred to me before. I realized how distinguishing between high and low quality earnings is essential for assessing risk and making more informed decisions. This became especially clear when I drew a connection to Tesla’s regulatory credit revenue. Some governments require automakers to meet specific emissions standards. Since Tesla only sells EVs, it earns excess emissions credits, and automobile companies that fail to meet the standards can purchase credits from them. However, regulatory credits revenue can decrease for Tesla if governments change emission credit policies or if other automakers sell more EVs. Despite the sale of regulatory credits accounting for about 40% of Tesla’s profits in 2024 (according to The New York Times), as Professor Shrand points out, earnings that come from unusual events are not reliable predictors of future performance.

Considering Tesla’s financials through this lens shows how much of its profitability rests on revenue that may not be persistent or “high-quality”. Tesla does clearly separate regulatory credits as a non-recurring revenue source, however, it makes me wonder how many other companies look profitable on paper due to one-time or non-recurring earnings. It also goes to show how accounting’s interpretation of numbers doesn’t just explain performance, it can also challenge assumptions, such as how much of Tesla’s revenue is sustainable.

When analyzing companies, I believe that the financials are the most reliable yet flexible way to analyze companies, and without a decent understanding of accounting investing becomes much harder. I always liked quantitative analysis more than any other part because it’s the base of the rest of the company. I don’t think you can analyze the qualitative parts of a company without understanding the financials. I totally agree with Professor Schrand on how important accounting is.

One point in this article that I can relate with very well is looking at non-aggregated financials. When I started doing analysis last summer going into 8th grade, I just looked at the financials and statistics on Yahoo Finance. Then, this summer when I started to look at the company’s earnings reports on their website, I learned there was so much information I was missing out on. For example, when I looked at the Yahoo Finance for the company I am currently analyzing (L3Harris), you just see that the revenue grew by around 2 billion, and I thought that the Space and Airborne Systems business would grow the most as I saw the importance of drones and other air-based defense systems when looking at the India-Pakistan war news, but I learned something very interesting when I looked at the non-aggregated earnings report. L3Harris actually had an 8% revenue decline in the SAS section as they divested from the antenna business in this section and F-35 sales declined. I also wouldn’t know about the LHX NeXt program, focused on cost cutting, and cutting the businesses that aren’t profitable. These cost cutting measures lead to about a 40% increase in operating margins, but it could also be because they spent less on one time purchases, because the adjusted segment operating margins (which exclude one time expenses) went up only 0.5% from 15.1% to 15.6%. After looking at this form of operating margin, it led me to wonder that even though the NeXt program is cutting costs, is it actually good for the company, as most one time expenses are a foundation, something that could be built on, potentially sacrificing future revenue and profits for larger margins now.

I think that doing quantitative analysis without crunching the numbers and thinking ‘why’, could significantly hurt your analysis of the company, your predictions, and your portfolio. The example that Professor Schrand gave about the company reducing R&D spending to increase profits is an example of this. If you just look at R&D, and profits, you might end up like most retail investors who do very little research, and just think: ‘R&D went down, but profits went up so it should be fine.’ But you should be thinking: ‘why did the earnings grow,’ if you get that margins went up, then ask ‘why did margins go up,’ and keep asking why. This is my personal strategy, I don’t know whether it’ll work for everyone, but this strategy has helped me make sure I didn’t miss anything in the financial statements. Regardless of whether my strategy works or not, I think the best way to ensure you don’t get fooled by these techniques is to have a solid understanding of accounting to understand what everything means.

I find your insights quite interesting, especially as you described your shift from passively scanning Yahoo Finance to actively looking into L3Harris’s strategic divestments. That shift, from consumer to analyst, is a powerful one, one I can appreciate having gone through it myself. Your insight about asking “why” when looking at financial statements reminded me of something I truly believe, that if brands are living organisms, financials are the pulse, the heartbeat. However, to feel that pulse, to interpret whether it’s adrenaline or arrhythmia, you must pair numbers with true nuance. That interpretation is key when predicting your ROI in any investment. I conducted research using a survey recently on luxury branding and Gen Z, and 92% of survey respondents admitted they don’t feel loyalty to any particular brand. This reflects that Gen Z doesn’t just consume products, in this era of tech where statistics and information is at our fingertips, we are decoding signals. When I read about L3Harris selling off its commercial antenna business, I saw a brand recalibrating its identity. “Divestment” might sound sterile on a spreadsheet but to me, it sounds like discipline. It sounds like innocation, and prioritization, the numbers telling us what happened but the words, the information tell us why. Looking into wording, I do think that experiential language is central to how brands build trust capital and long-term equity, why companies like Apple don’t just sell. At the end of the day, like you said, anyone can look up numbers on Yahoo Finance, anyone can say “margins rose.” But it’s different when you use experierntial lanuguage, when you say margins expanded like lungs exhaling tension, smarter, and intentional. This is the difference language makes, why finance and branding are so intertwined in the modern world.

My mom is an accountant. Boooringggggg.

No kid (myself included) grows up thinking, I want to be an accountant. What is that, anyway? Excel spreadsheets, crunching numbers, glorified human calculators. Oh, I was so wrong.

Starting my internship at Deloitte Academy, being an aspiring corporate strategist consultant, I had big dreams. This was my breakthrough moment. I was going to get a taste of the pinnacle of elite management, risk advisory, and strategy decisions.

So, when I sat down at my first meeting with a packet on top of my desk and a slideshow displaying the words Accounting 101, I was dumbfounded.

Unbeknownst to me at the time of applying, although Deloitte is one of the largest consulting firms in the world, it’s even more highly regarded as a part of the Big Four accounting firms. My hunt for corporate glory, while completely disregarding even the idea of accounting, ironically led me into an internship about accounting—perfect.

My mom’s job had never been the exciting detail that sparks conversation in my life, but suddenly, I wished I had asked her more questions.

Over a month, various high-ranking Deloitte accountants fundamentally changed the way I view the role.

Beyond the hundreds of thousands of different roles, job security, and high salaries, I learned that accounting represented possibilities. Just as Professor Schrand compares accounting to “financial forensics,” I would even take it a step further and say it’s the entire inner working of corporate American success.

Accountants foresee the future: prediction, intuition, decision. Accountants transform numbers listed on a financial statement into a prediction of future company performance, use their intuition to provide a solution, and make an end decision to positively impact a company.

Accountants change companies—just like I wanted to do as a consultant. Like Schrand notes, accountants “value company stock” (essential for M&A), “disaggregate financial components” (highlighting where to cut costs), and assess risk (vital to risk advisory). Accountants run the show behind the curtain.

My desire to be the “bigshot management consultant” hadn’t disintegrated (I connected with many Deloitte consultants throughout my internship), but I quickly came to realize just how essential and complex accounting was to any company’s success. It establishes the foundation for consultants, C-tier executives, and product managers to make their decisions—it’s more than just numbers.

Although I wish I had been more curious about my mom’s career in the past, I’m glad this internship opened my eyes and changed the way I think about my future pursuits.

Looking at my Common Application now, there is more than one college with “accounting” checked underneath the “major” question—something my 11-year-old self would never believe.

I found this article highly meaningful, especially in light of what I learned through the Wharton School’s Essentials of Finance course. Before attending the WGYP residential program, I perceived accounting as little more than tracking meaningless numbers and filing routine reports – something relevant mainly for preventing fraud. Although I had a strong interest in the finance sector, my two-week experience at Penn simply revealed just how limited my actual understanding was, despite what I previously believed.

Being instructed by two Wharton-trained finance scholars, Professor Greg Nini and Professor Bakang Mabisi, gave me a transformative perspective. They showed me that a robust foundation in financial analysis begins with a solid grasp of accounting. Starting from the fundamental financial statements, which encompass the cash flow statement, balance sheet, and income statement, professors offered me an insight into the complex financial models such as the Discounted Cash Flow (DCF) and the Dividend Discount Model (DDM). Examining sophisticated models completely changed my way of thinking, since I didn’t expect that a seemingly insignificant number plays a crucial role in calculating the firm’s proper value.

When I read Dr. Shrand’s article, I strongly connected with her statement that “Small changes in earnings persistence (the continuity of earnings from one period to the next) can dramatically impact a company’s valuation.” During the WGYP session, my team worked on DCF models, and since most of us were unfamiliar with such detailed calculations, we made several minor input errors. Even when the incorrect inputs didn’t seem far off from the right ones, the final results came out completely different each time. In some extreme cases, we even ended up with negative valuations when the correct result should’ve been positive. What I took away from this was that while mistakes are part of the learning process, it made me wonder what happens when someone in investment banking doesn’t fully grasp the fundamentals, yet is still in a position to evaluate companies. One small input error can completely flip the outcome, and this exercise made that risk feel very real.

The DCF model tied together everything from fundamentals like Cost of Goods Sold (COGS) to more technical details like amortization, which helped me realize how precise and interconnected financial analysis really is. This hands-on work helped me appreciate accounting’s essential role within the finance sector, making me strongly agree with Dr. Schrand’s view that accounting numbers, when understood strategically, are powerful tools for evaluating a company’s true health and potential.