Getting Creative with Money

As Financial Literacy Month 2018 in the U.S. comes to a close, we want to highlight a few more champions of youth financial education. As the KWHS Investment Competition illustrates (our Global Finale is this Saturday, May 5!), creativity, experiences and hands-on learning can be effective ways to teach money concepts and prepare high school students for making better decisions about their money.

So, for this story we turn to the U.S. state of Michigan – more specifically, Oakland County, where for the past seven years county treasurer Andy Meisner has run a Financial Literacy Multimedia Art Contest for high school students. Winners earn college scholarships and the chance to have their work displayed in the treasurer’s office. The champions here are local government, educators and students, all coming together to embrace the importance of financial skills.

Michigan is one of several states in the U.S. that require students to learn about personal finance before they graduate. Michigan students must take a half-year economics course in order to earn their diplomas. Meisner’s contest takes those lessons to an entirely new level as students find creative ways to convey the underlying messages of financial education through different mediums like drawings, photographs, water color paintings and videos.

Promoting financial literacy and education is a personal passion and primary focus of Meisner’s office. “Now more than ever, our students must be equipped with the financial literacy skills they need to control their finances, instead of their finances controlling them,” Meisner said. “My hope is that students can use their favorite art form to think in new ways about money and finances, and that we can increase awareness of this critical area.”

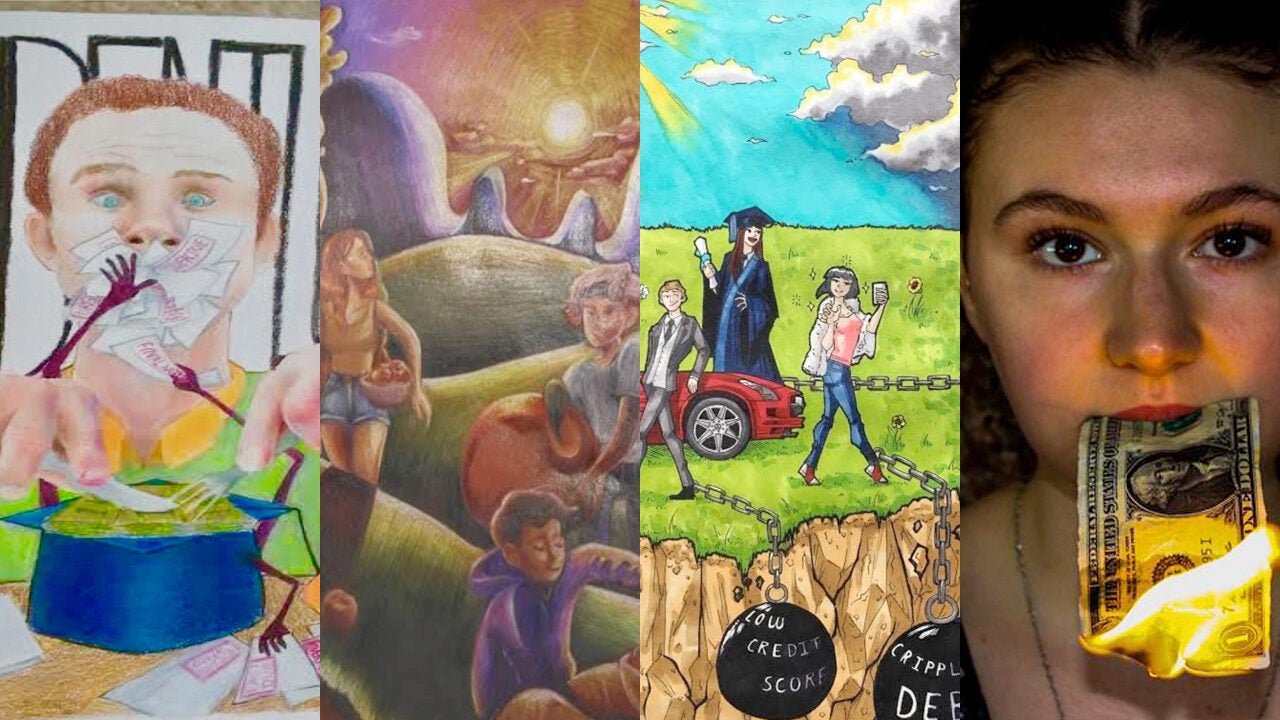

This year, 24 students from nine different high schools won $9,500 in scholarship money. The grand prize winners who received $1,000 each (art from who is featured in the montage image at the top of the page) included Seoyeon Koo, a 9th grader from Rochester Adams High School who created a 2-D colored pencil drawing titled “Desperation to Dispense Student Loans;” Emma Mackela, a 10th grader from Lake Orion High School who created “New Horizons,” a 2-D colored pencil drawing; 11th grader Christine Cho of Rochester Adams High School who created “Welcome to the Dark Side,” also a 2-D colored pencil drawing; and finally, Olivia Barone, a senior at Stoney Creek High School with her video digital artwork, “Don’t Bet on Jet.” Student loans, debt, credit reports, savings: these concepts are all expressed in creative and compelling ways. #LetsTalkMoney

Does your town do something similar to this contest to promote financial literacy? Tell us about the creative ways you are learning about money in the comments section of this article.

What do you consider the most important financial issues facing young people?

Do you ever talk about money in your household? How do your parents discuss money with you? Do they avoid it? How might you start the conversation at home?

Me and family do talk about money sometimes, depending on the situation were are at the moment, they don’t say much too me about though. Whenever they discuss money with me its always just about how i can earn it from them about and how much, they don’t really talk to me about bills and stuff like that.I don’t think they avoid it, am just not interested in knowing bout bills and stuff like that yet, But some day i could ask them how it works.

Student debt and loans are big financial issues students are dealing with currently. My parents discuss money at home through their taxes, and work.

my family taught me the value of money at a normal age. Although, as a family we do not like to talk much about money, I have spoken seriously with my family about what would happen if we have economic problems. My father also introduced me to different aspects of money and how to handle it correctly.

I consider the most important financial issue that young people face is saving money and using it irresponsibly. As young people, we are not prepared to save the money we make and use it to pay for our necessities. Young people are used to spending their parents’ money and using it for whatever they want. When it gets to the point where we don’t have endless money it becomes an issue.

My town doesn’t do anything creative projects to take about finance and financial issues, however in my school we have a financial program. In this financial program we learn about handling money, as well as financial jobs.

The biggest issue relating to finances that face young people is the overall education of how to handle money. Young people these days are not properly educated on how the financial system works, as well as how to properly budget their finances overall.

In my family, we discuss finances. My parents believe in keeping me educated on our financial situation in order to understand the importance of money, and that is it important to always save money, not spend it all right away.

I agree with you on the point that the biggest problem teenagers are facing nowadays is about how to manage their personal finances well. While it is true that many young people in my country doesn’t know how to properly handle their incomes and expenses, I think the money-related issues that the teenagers in my country are facing is more than that and it’s worth exploring their challenges here. I wish to elaborate further on some of your points here, in a local setting.

I am a 18 year-old student from Malaysia, therefore I think that I understand the challenges my peers are facing and their struggles should be voiced here. As you know, Malaysia is a multiracial country composed by three major races: Malays, Chinese and Indians. I think that the challenges faced by my Malays and Indians peers are different from that faced by my Chinese peers.

Let us start with the Malay and Indian teens. The financial problem they are facing is primarily their lack of exposure to personal-finance management. The common characteristics of them is that they have no idea of saving money to weather the storm. In fact, their mindset is that why save the money if you can use your hard-earned bucks to buy whatever you want? To them, life is only that long and we should indulge ourselves in spending for things that we enjoy and stuff that we like irregardless of their cost and their impact to our financials. A large part of their happy-go-lucky attitude towards money can be attributed to the poor (the appropriate word here should be nil) financial education given to students across the country. From elementary school to high school, everyone is taught about how to converse using English and Malay, how to calculate probabilities, and why the rainbow has seven colours, but not even a basic concept in financial education, such as saving, is taught in the school curriculum and part of the syllabus. Our country’s education department naturally assumes that students should have grasp basic financial knowledge since kindergarten and they should have learn it from their parents. Alas! the reality is that a large share of those students’ parents have never received higher education before (as receiving formal education is less affordable and less important in the last generation), let alone financial education. On top of that, a sizeable proportion of Malays live in the rural area and that definitely contributes to their lack of exposure to financial knowledge. The inevitable outcome of such situation is that no one is there to take the responsibility of teaching basic financial knowledge to the next generation and hence the aforementioned attitude towards money-management.

Next, we examine the what’s the money-related issue facing Chinese teenagers. My friend Chris is leaving his hometown to study in another city of Malaysia. That means he has to handle his own money well so that he will not go out of budget every end of the month. Chris knows that he shouldn’t spend more than he has, he knows the importance of saving, he also knows that investing his money wisely would have been great. The problem is, how should he invest his money wisely to grow his fortune? From this scenario, we already know that, generally speaking, Chinese teens (mostly in urban areas) acquire basic financial knowledge and know the vitality of saving money. A large part of their financial literacy is owed to their parents. Due to our culture, traditional values and historical roots, most Chinese inculcate the value of saving hard in their offsprings since an early age. That’s why the general attitude of young Chinese towards money is “work hard, save hard”. But as time changes, those teens realise that merely saving is not enough. A confluence of rising prices of basic goods and a meagre salary base for fresh graduates out of college makes enjoying a good life after graduation more elusive than ever. To add insult to injury, future obligations such as mortgage loans and car loans will only make their financial burden heavier. Hence, they begin to find ways to invest their money, in hope to multiply their wealth and live comfortable lives. That’s how pyramid schemes and illegal forex trading get popular among young age groups.

As a result, the behaviour of young adults of all races with their money brings substantial impact to the country in a macroeconomic perspective. The disposition towards lavish spending among the Malays and Indians community causes the marginal propensity towards spending of Malaysia to be dramatically high. At the same time, more spending activities in the economy implies less money plowed into the banking system. This, in turn, causes less projects to be funded and sub-standard infrastructure growth to be produced by the private sector. Low savings rate also means that during an economy recession, the aforementioned individuals will be suffering with their financials and may contribute indirectly to social conflicts and political instability. On the other hand, the desire of Chinese youngsters to multiply their wealth in a ‘fast and furious’ way give rise to pyramid schemes and illegitimate forex trading. The pyramids schemes mentioned above typically disguises themselves as a direct-sales company to gain popularity among the teenagers. Several prominent examples of these schemes such as JJPTR and MBI gain unprecedented popularity among local communities across the whole Malaysia. When the cycle becomes unsustainable and busted, the savings of those teenagers that were late-movers were entirely wiped out, with no one to bail them out. Another phenomena stemming from the ‘fast and furious’ mindset of growing wealth induces Chinese teenagers to plow their money into financial instruments and risky assets which they are not even familiar with, such as forex trading, derivatives trading and penny stocks investing. Not to mention that such rampant inflows of capital could cause multiple asset bubbles in the country, teenagers’ ignorance towards markets and the underlying risk could jeopardise their parents’ life savings. It’s too late to say sorry that time.

Pointing out problems without giving out solutions is deemed to be irresponsible. Here, I think what Madelyn says make sense, as nowhere is better than the school to sow the seeds of financial literacy. Furthermore, starting a ‘universal financial literacy’ revolution in the school gives all races, irregardless of their family background and economic condition, equal opportunities to be exposed to financial knowledge. I think the education ministry should include basic financial classes into the school curriculum. However, as opposed to the school-led financial programme in Madelyn’s school, I would think that there will be better outcomes if the school plays a more passive role in such programmes. Specifically, the school can incentivises students to take an active role in such programmes, such as starting their own personal-finance club, entrepreneur clubs, collaborating with outsiders to organise PF-related workshops and organising finance-related contest in the schools. On top of that, the government can lend a helping hand in boosting such efforts through subsidies, sponsoring contest prizes and allocating budget to each schools for the ‘universal financial literacy’ programme.

All in all, thanks Madelyn for your opinion and inspiring me to speak up about the money-related issues faced by teenagers in my countries.

I consider the most important financial issue that faces young people to be debt. Most students take out loans to help pay for their college tuition and other related expenses: textbooks, meal plans, housing, etc. But, after college is over, they struggle to repay their loans. As the years go by, the costs of their loans increase because of interest. In addition, there are many new costs that arise after graduation. Such as an apartment or place to live, utility bills, transportation, and food. For many young people fresh out of college, finding a stable job that offers a living wage is difficult due to their lack of experience. As a result, the expenses rack up while they don’t even have a stable source of income.

It my city there aren’t many things like finance projects but in my school we have deca which has to do with this sort of thing.

One of the biggest problem is that many young people of have to much money and they don’t know what to with it and it’s because they are just uneducated. My parents inform me how money should be spent according to necessities first instead of pleasure plus my mom is a financial analyst so I’m pretty sure she knows a few things about how to handle money.

In school they should have more classes to do with money and how to properly save and invest your money in things that could help you in the long run. By learning this at a younger age it could help us pay off debts easier, and help us to know its better to save rather then to spend.

I agree many young people have a lot of money and they just use their money on their wants and not save it for when they really need it. Many young people don’t really save their money they just use it on whatever will pleasure them and when they need the money badly they won’t have any because they were not smart with handling their money.

My town does not necessarily do much to promote financial literacy, but there are many ways that my town teaches about money. For example, school clubs like DECA focus on many business topics, including finance. Financial information is more common in school nowadays.

In my opinion the most important financial issue facing young people is how to use money and what to spend it on. Usually, young people spend their money and goods rather than needs, for personal reasons. This will affect them when they are older because they will not know how to properly budget their money and allocate it to the necessary areas.

My family and I talk about many topics, including money. The things we say about money include jobs that any of the kids could get for money, how much things cost, or international financial issues. My parents do like to discuss money with me. I might start a conversation about money at home by introducing the main topic, then going into the financial view of it.

My town doesn’t really do much to promote financial literacy unless you specifically take classes about finances. My school does offer options to take finance and other business classes which I take to prepare myself for the future. I consider the economy the most pressing financial issue facing young people today. We don’t really talk much about money in my household but I could promote talking about money more by trying to take a more active role in attempting to understand my family’s finances.

My town doesn’t directly promote financial literacy, however, in the school, we have the opportunity to take classes in the field of finance. The classes are extremely helpful and interesting. In addition, we get a chance to participate in competitions with more than 50 types of events to improve our skills in the real world. A creative way to learn about money is by participating in competitions, starting small businesses, and learning in school.

I believe that the most important financial issues facing young people are the accumulation of debts, which can follow them to the rest of their lives if they don’t know how to handle it.

As a mature 16 years old, I have talked a lot about money in my household. I’m always very curious in subjects involving taxes, credit, and saving money. We discuss it regularly and naturally. I normally start the conversation due to the fact that I’m about to start a small business and I want to learn the most from my family. They give me pieces of advice and strategies to avoid certain problems in the future.

My town doesn’t do anything similar to this contest to promote financial literacy. However, DECA classes are offered at my school in which programs for finances are offered.

In my opinion, debt is the most important financial issue facing young people, due to being financially illiterate. Because of their financial illiteracy they are not able to properly manage their money in a way that is beneficial to them.

My mom and I often talk about money. My mom sees it fit that I know about our financial situation, and sees me as mature enough to understand what she is saying. I also see it as important to know of these things because through these talks, I am gaining experience without even participating myself.

Similarly to how your school offers DECA classes, my school has a DECA club. However, it isn’t publicized to the point where many people know what the club is and what it does. On top of that, we don’t have any courses explicitly targeting personal finance that are available and accessible to everyone. We do have some general economics courses, but those are nowhere near as helpful as a true personal finance course would be.

I completely agree that debt is the most important financial issue that young people face today. Until college, most of our parents pay for everything. Many of us don’t realize the importance of money. For me, basically all the money I spend comes from my parents, which I spend as I will. We tend not to worry about financial issues unless they are very significant, because our lives often revolve around school and later college applications. That’s why many of us don’t realize just how expensive college is until the time comes. Schools tend not to emphasize on the importance of financial literacy, and therefore, we can graduate without knowledge of even basic life skills like paying taxes.

If our parents don’t discuss these kinds of problems with us at home, many teenagers will never understand until it’s too late and suddenly get hit with all this information about financing when they turn the legal age. Some parents may also purposely avoid talking to their kids about their financial situation because they don’t want to burden them. In that case, even kids from families in tough financial situations might not know about personal finance. Since my parents own a store, the topic of money comes up a lot, especially since business has stagnated in the past few years. They have included my siblings and I in the conversation and helped us understand some of what was going on. Whenever they come home from work, we ask them how business was that day. Even if they made a decent amount, they explain how in reality, it’s really not that much. They still need to pay employees and rent for the storefront. Because we come from a low income family, money is always a concern when it comes to college. I am often reminded about how student debt could be burdensome to our family, and it has made me become much more aware of all the struggles that are to come. However, if we were taught these things in school, I could actively engage with my parents rather than only hearing their experiences. As household debt rises while wage growth stagnates, I know what my family’s situation is not uncommon. Bringing attention to personal financial skills is more important than ever for the next generation.

My town does not do similar things to promote financial literacy. At our schools there are DECA business classes offered, where students can learn about finance, including a whole class about it called “Personal Finance”.

The most important financial illiteracy that the youth face is how to spend money responsibly. Many kids get money and burn it right away, just because they were given the opportunity to. They do not save as much as they should.

We do talk money in my house, as my parents came from unprivileged backgrounds where they had to work hard to get to where they are now. They always explain to me why spending money wisely is important, and show great examples of how some people we know got broke. These talks have helped me spend my money in better ways and prepare for the future.

My family discuss about money, and financial issues all the time. My dad specifically aims for me to understand the basics of maintaining a stable financial base. We talk about saving money, budgeting, ways to conserve for what we need more than what we want. This all in part will transcend to helping me in the future in college, and when trying to build a family of my own.

It is good that students are learning to be in control of their money instead of the other way around. Kids aren’t often taught well enough how to manage their money, but this changes the way that students can learn to maneuver as adults in the real world with money. There should be more opportunities for students like this in all schools.

Does your town do something similar to this contest to promote financial literacy? Tell us about the creative ways you are learning about money in the comments section of this article.

My city doesn’t do anything similar to this contest to promote financial literacy. However, there are many classes offered in my school relating to finances.

What do you consider the most important financial issues facing young people?

The most important financial issue facing young people is the early on set of debt because they don’t know how to spend their money properly. If young people learned how to use their money properly they would know when to save and spend their money.

Do you ever talk about money in your household? How do your parents discuss money with you? Do they avoid it? How might you start the conversation at home?

My parents and I talk about money in our household. I usually start the conversation whenever my parents are discussing money management for taxes, shopping or for the month’s rent.

This is very helpful for students of our country but not all student of the world don’t get a scholarship as well as chance how to learn money.

I think every institute have to start scholarship system to dwindle unemployment problem so that all can be essential to contribute economically to their family and country.